Income tax department have made the PAN card easy for its holders as one does not require carrying their PAN card physically all the time. The Income Tax Department has made PAN information available on its website. Now a PAN card holder can find their PAN card number or find the address listed under your PAN number on the e – filing website easily.

| Some Important Links Related To The PAN Card | |

| PAN Card Information | Click Here |

| Apply For The PAN Card | Click Here |

| Track PAN Card Application Status | Click Here |

| Form 49A | Click Here |

| PAN Card For NRI | Click Here |

| PAN Card Correction/Update | Click Here |

| Re Apply For Lost PAN Card | Click Here |

| Apply For Duplicate PAN Card | Click Here |

| PAN Card Link With Aadhaar Card | Click Here |

Know Your PAN Card Number

On the e – filing website you can find your PAN number by just providing your name and date of birth. Follow the below mentioned process to know your PAN number by providing your name and date of birth:

- To start with the procedure, you are required to log in to the official website of e – filing i.e. incometaxindiaefiling.gov.in.

- On the home page, click on “Know your PAN” option from the quick links.

Know your Pan incometaxindiaefiling.gov.in - Upon click on the above mentioned option, you will be redirected to a new page where you will have to fill in a form and provide details such as date of birth, date of incorporation, surname, middle name and first name. Enter the captcha code that is displayed on the screen and click on submit.

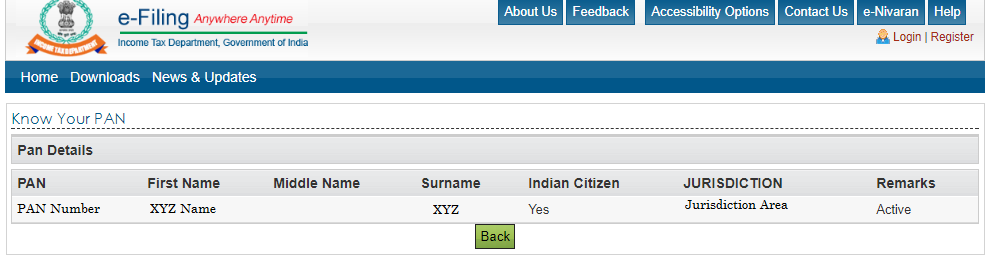

Know your Pan incometaxindiaefiling.gov.in - As a result you will be provided with information such as your PAN card number, your First name, your Middle name, your Surname, Jurisdiction and also a Remarks section which will state whether your card is active, inactive or any other status.

How to know your PAN Card details from Income Tax Website

In order to find out any other details of your PAN card including your address, you can do so by registering yourself on the Income Tax Department e – filing website and then follow the below mentioned procedure:

- Visit the e – filing website and click on “Register Yourself” and select your user type and click on ‘Continue’.

How to Register incometaxindiaefiling.gov.in - Now the PAN card holder is required to provide their basic details.

How to Register incometaxindiaefiling.gov.in - Now fill up the registration form with correct information and click on ‘Submit’.

Registration Form incometaxindiaefiling.gov.in - Now the applicant will receive an activation link which will be sent to the applicant’s email ID provided by you. And click on this link to activate your account.

- Now login to your account on the e – filing website and select “Profile Settings” and then “My Account”, upon clicking on this you will get the following information.

Registration Complete incometaxindiaefiling.gov.in

- PAN number

- Name of Assess

- Date of Birth

- Gender

- Status

- Address of Assess

How to check the status of your PAN card

Once you have submitted your online application for your new PAN card, you can also keep a track of your PAN card. The online application methods are both easy and hassle free.

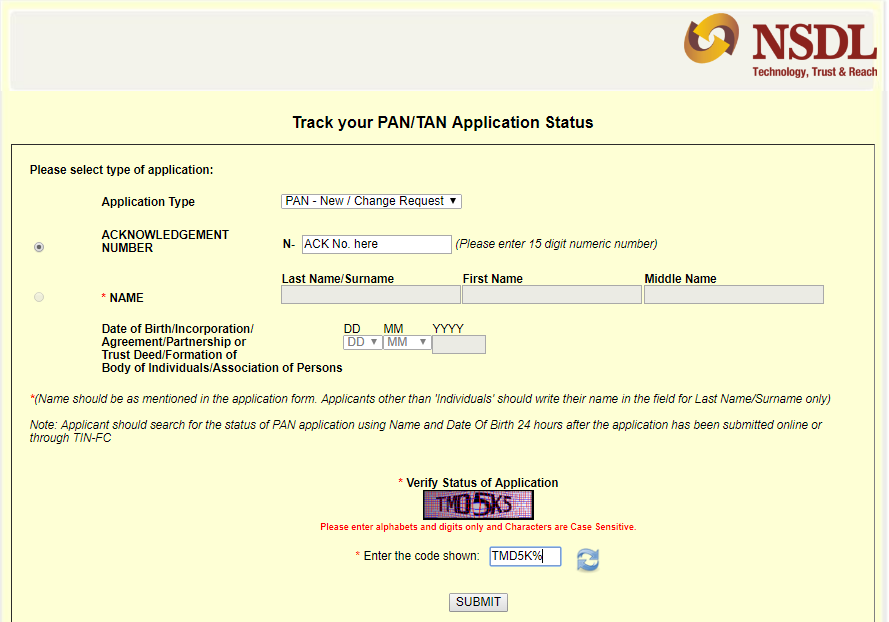

- In order to check the status of your new PAN card, you are required to log on to the official website of PAN, TIN – NSDL: tin.tin.nsdl.com

- After that go on to the PAN section on the website. On this page the applicants can check the status of their application.

- Now the applicants are required to choose the application type that they are filling in.

- Now in this step the applicants will have to provide few details along with their 15 – digit acknowledgement number i.e. their full name and date of birth.

PAN Card Status tin.tin.nsdl.com - Once the applicants have filled in the required information, they will be directed to a page where they can see the status of their application.