Home » Investment (Page 2)

Category Archives: Investment

VPF – Voluntary provident Fund Eligibility, Interest Rates, Benefits, Calculator

The Voluntary Provident Fund VPF is one such way to bump up your retirement savings amount. Not only this, it will also provide you the tax benefits as well. Basically, a Voluntary Provident Fund is a traditional version of Provident Fund Savings Scheme, where the subscriber retains the control to periodically assign a specific amount to his/her provident fund, as a part of his/her Voluntary contribution.

Asides from being a clever tax saving option, it also provides/offers a long-term savings option. This type of Provident Fund has become a quite popular tax savings instrument, for the employed sections of the society.

Eligibility Criteria for the VPF – Voluntary Provident Fund

The Voluntary Provident Fund is especially an extension of the Employee Provident Fund (EPF) where the applicants have to invest 12% of the contribution factor that applies to their traditional EPF Accounts. The Voluntary PF Option is mainly entitled to the employed sections or the salaried individuals who receive their monthly pay through a designated salary account. The people who are working under the unorganized sector or the non-salaried employees can open a PPF (Public Provident Fund) account at the Local Bank or the Post Office.

VPF Account Interest Rates

The Government of India decides the Interest Rates of the VPF for each Financial Year. The current interest rate of the VPF is 7.6% for the year 2016-17. The amount of money accumulated in the VPF Amount is eligible for the Tax Deduction under the Section 80C of the Income Tax Act. This Provident Fund Scheme interest scheme has attracted a lot of Indian’s to apply for it.

Government lowers Interest Rates of Small Saving Schemes and PPF…Read More

Benefits of the Voluntary Provident Fund (VPF)

- Safe Investment Saving Option

The Voluntary Provident Scheme is offered and managed by the Government of India. Therefore it is tagged as the safest and trustworthy investment medium with no risk. It is usually associated with long-term investment plans that are offered by the Private Players.

- Simple and Easy to Apply

This provident fund scheme is very easy to apply. All you have to do is to raise a request with the payroll/finance/ HR Team with regards to the opening of the VPF Account. You can do it by simply applying for the VPF Fund Registration form and immediately after, the EPF account will serve as the new VPF Account. This account can be opened at any time of the Financial Year.

- High Rate of Interest

The VPF Accounts are known for their high yield. Currently, the rate of Interest is 8.65% which is still impressive.

- Potent Pension Fund

The amount that you have invested in the VPF can be withdrawn at the time of the Retirement or Resignation from the Current employment. These act as the long-term investments and comes in use if the regular monthly income is not available.

- Tax Savings

The employee’s contribution towards the VPF Account is eligible for the deduction while accounting for the tax, to the tune of Rs 1 Lakh. The income that is generated through the interest is not taxable, provided the monies derived isn’t in excess of the base interest of 9.50%. The accumulated amount if withdrawn before the account completes 5 years subject to the taxation.

- Easily Transferable

The VPF Account can be easily transferred from one employer to another employer. Thus, the change of the job is not going to affect the benefits of the regular VPF Contributions. Not only this, the accumulated money is also transferred to the nominee as nominated by you or your legal heir.

VPF Calculator

When you are involved in any long-term savings or investments, there always lies a pinch of curiosity in the final monetary account. That is what, a resourceful investor thinks while making any investment plan. Therefore, to solve these sorts of issues, there are simple online tools available. One of such innovative tool is the Voluntary Provident Fund Calculator.

The Voluntary Provident Fund Calculator makes the complex calculations within seconds. This provides an investor a basic knowledge of how much money should be invested periodically to attain a planned target payout. The VPF Calculator utilizes the following input points to enumerate the VPF Payment Strategy.

- Base Monthly Salary

- Percentage (%) of salary to be contributed to the VPF Amount.

- Monthly Contribution to the Employees Provident Fund (EPF).

- Employees Contribution to your EPF Account.

- Current EPF Balance

- Applicable Interest Rate.

VPF Registration Form

There is no specific registration application form for Voluntary Provident Fund. But however, if the employee is interested to invest some amount in the VPF, then he/she has to intimate the same to his/her payroll teams and the latter will be converted into the applicant’s EF Account to VPF Account. But for this procedure to happen, the concerned employer must be registered with the Employees Provident Fund Organization of India. The employee has to fill in a Business Establishment Registration Form. The form will be processed and will be taken action by the aforementioned EPF Office. Post this, the employer can participate in the EPF Routine and consequently, the concerned employees can request for the opening of the Voluntary Provident Fund account.

Various steps that are involved in the process are as follows

- The Employee requests the employer for the additional deductions from his/her salary in the favor of the Voluntary Provident Fund. This can be done any time of the Financial Year.

- The employee must fill in the basic KYC Form and sign it appropriately and forward it to the same payroll/ Finance/HR Department of his/her company.

- Upon reception of this form, the company’s payroll team will confirm the accuracy of the supplied details and graduate the employee’s basic EPF Account into the requested voluntary PF account. Thereafter, a stipulated percentage as mentioned by the employee will be deducted from his/her salary as the VPF Contribution.

- The Basic Format of the Voluntary Provident Fund Form must include the following details:

- The date from when the EPF Contributions are made.

- Status as not an “excluded” employee as stipulated in the EPF Scheme, 1952.

- Percentage of the salary that is permitted to get deducted as the contribution to the VPF Account. Also, the date is also included from when this will be applicable.

Tax Benefits from Voluntary Provident Fund Scheme

When we talk about the Financial Taxes and its effectiveness and tools and investment benefits then the Voluntary Provident Fund comes in priority. According to the latest regulations, the investor can relish a tax break-up of up to Rs 1 Lakh as stipulated by Section 80C of Indian Income Tax Act. All the investments in the VPF Account are considered from the employee’s pre-tax income. Further, the income that is derived from the interest amount from the VPF will not be taxed unless the interest rate exceeds or matches the rate of 9.50%. And if in case, the employee wants to terminate his/her account before the stipulated 5 years tenure then the tax will apply, otherwise, the withdrawal is deemed tax free.

Rules & Regulations that Govern the VPF Scheme

The Indian Government states that the Voluntary Provident Fund is one of the robust investment schemes which provides the benefits to the employed class of people. It has been seen that there is a segment of the population that has a buying power, financial foresight and propensity to create long-term plans. Along with that, this investment scheme provides a seamless, safe and involves a very minimal input of time and energy. In return for that, the employer also enjoys the robust pension fund, medium-term savings instrument that can mature in a certain period of time for a long-planned financial requirement. It also provides a high-interest rate and an easy management. Thus, we can say that the Voluntary Provident Fund has been a popular choice amongst the employed sections of the population.

Applying for the Voluntary PF is very simple. Below is the list that talks about the various rules and regulations that govern the Voluntary Provident Fund Scheme in India:

- The employee can contribute as much as 100% of his/her salary towards the VPF Account. This contrasts with the EPF account wherein he/she can contribute a maximum of 12% of his/her basic salary.

- The VPF Scheme is a subset of the Employee Provident Fund Scheme wherein the only differentiating factor is the percentage of the contribution that the concerned employee can appoint, as compared to the fixed 12% that applies to the EPF account. Thus, there is no separate account for VPF.

- Only the salaried employees who are working with the organizations which are tied up with the EPFO can only open and maintain the VPF Account. The self-employed individuals and the people working in the unorganized sectors are not applicable to open a VPF Account.

- The employers are under no obligation to contribute their employee’s VPF Portfolio.

- The VPF Accounts can be opened at any point in time through the Financial Year. However, the investments to the same cannot be terminated/discontinued before the base of the tenure of 5 years is completed.

- It is best to start the VPF Account at the start of the financial year. This will help in the better financial planning and tax savings. The onus lies with the concerned employees to affect this by intimating his/her employer about the same.

- The applicants must also note that the VPF Account interest rates are decided at the start of the financial year by the Government. These rates can be either increment or decrement as compared to their previous years. Thus, all the applicants must pay an attention to the VPF Interest Rate that applies for the specific financial year before signing on the dotted lines.

- If the Indian Government’s ambitious Direct Taxes Code (DTC) comes into effect then the entire VPF Amount at the time maturity period is liable to be taxed. The DTC is a proposed regulation from the Indian Government that simplifies the direct tax laws that are currently working in India. In short, the main objective of the Direct Taxes Code is to simplify and revise the Direct Tax Laws implemented in India.

- The VPF account also allows partial withdrawals as loans, with also the possibility to complete withdrawals. If the withdrawal takes place before the account has completed 5 years of existence then the tax will be applicable on the accumulated maturity amount.

- The Final maturity amount is payable at the time of the retirement or the resignation from the employment. The amount can also be transferred from one employer to another employer (in case of the EPF accounts m) and on the unfortunate death events of the account holder, the assigned nominee/legal heir will gain the possession of the accumulated balance in the VPF Account.

Documents Required to Open a Voluntary Provident Fund

As told earlier, the Voluntary Provident Fund is the fragment of the Employee Provident Fund. This can be applied by simply forwarding the request to the concerned company’s payroll/finance or HR Department. The application form mainly consists of the employee’s basic information that concerns the payroll team to deduct a specific percentage of an amount from the employee’s basic monthly salary as the VPF contribution.

The documents that are required for the Voluntary Provident Fund Registration are:

- Your complete company profile

- Certificate of Business Registration (Form 9 and Form D)

- Forms 24 and 29.

- MOF- Company Registration Certificate

- If Company is a “Sdn Bhd”- Memorandum and Articles of Association

- Other documents as when required (mentioned).

VPF Withdrawal Process and Withdrawal Forms

The investments that come under the VPF Scheme is quite popular and is one of the biggest reason is that, the money that is accumulated in the VPF account can be withdrawn at any moment in time. But there are certain conditions that are applied to these schemes. This accumulated money can be used immediately in case of emergency cases such as health issues etc. A depositor can break his/her VPF account for some fixed reasons. Some of them are as follows:

- Medical treatments for the account holder or his/her family members.

- Cost Intensive events such as higher education and marriage.

- For the construction/purchase of the house/plot of land.

- Home Loan Repayments.

Note:

If you are terminating your VPF account before 5 years of existence, then you will be charged tax deductions on the accumulated funds.

For withdrawing a certain amount from his/her VPF account, the person has to provide a Form 31 through his/her employer. Form 31 is known as the application of advance from the EPF Fund. This can be downloaded from the EPFO’s Official website. The form consists of the details of the employee, postal address, EPF Account Number, bank details etc. The application form must be attested by the concerned employer.

Now PPF Goes Online – A New Service by ICICI Bank

The India’s largest Private Bank ICICI Bank launches a digital service that allows the customers to open PPF Account through Internet Banking or Mobile Banking. Adopting this new digital facility will ease up the process and will reduce the confusion of the submission of the paper documents.

| Some Relevant Links | |

| ICICI Bank Credit Card Customer Care Number | Click Here |

| Link Aadhaar With ICICI Bank Account | Click Here |

| ICICI Bank IFSC Code | Click Here |

The customers now no longer have to visit the bank branch and wait in the queue and submit the physical documents to open a PPF Account. They can now do it anytime, anywhere using the bank’s digital channels of Internet and Mobile Banking.

The bank said that it is a first lender in the Country to introduce a complete digital and paperless procedure for opening a PF Account. This facility is completely available online (24*7) and on all days. The customers have to log in to their Internet Banking or Mobile Banking for applying for a PPF Account.

National Pension Scheme (NPS)

Planning for your retirement is one of the most important things to do in these days and for this purpose investing your savings in the National Pension Scheme is the best option to choose from. The National Pension Scheme is a retirement benefit plan promoted by the Government of India. It is low-cost, tax-efficient and flexible retirement savings scheme launched by the Government. The scheme provides a lot of benefits and investment options to the employees.

The National Pension Scheme was launched on 1st January 2004. Earlier this scheme was only applicable for the Central Government Employees only but later in the year 2009, it was allowed from the age limit of 18 years to 60 years. Under the NPS, your savings will be invested in a pension fund by Pension Regulatory and Development Authority (PFRDA).

| Some Important Links |

| How To Open NPS Account |

| NPS Statement/Account Balance |

| Link NPS Account With Aadhaar Card |

The NPS has two types of accounts

- Tier-1 Account which is compulsory for every subscriber. In this account, you cannot premature you withdraw money before the age of retirement.

- Tier-2 Account, which is optional in nature. You can open a Tier-2 Account if you have opened Tier-1 account first. In this account, you can premature the withdraw money before the age of the retirement.

Pension Fund Regulatory and Development Authority (PFRDA)

The Pension Fund Regulatory and Development Authority which is otherwise called as the PFRDA is an independent organizing body that is established by the Indian Government to regulate and oversee the pension funds in India.

The main objective of this regulatory body is to encourage the citizens to secure themselves financially by securing the subscriber’s pension funds as well as their interests. It also ensures that the NPS is administered as per the rules and the provisions that are laid down in PFRDA Act.

Eligibility Criteria for National Pension Scheme

The eligibility criteria for the National Pension Scheme is:

- All the citizens must have an Indian Nationality.

- They should be under the age criteria of 18-60 years.

- The Non- Indian Residents can also join if they have their bank accounts in India.

A person who is declared insolvent and has an unsound mind is not eligible for the National Pension Scheme.

When you subscribe to the New Pension Scheme, you are given a unique account number which is called as PRAN which s otherwise called as the Permanent Retirement Account Number.

Interests Rates Offered by the National Pension Scheme

The NPS does not provide any particular interest rate. However, the NPS schemes can earn a subscriber anywhere between 12%-14% interest which is quite high, while taking any investment options into consideration.

Features of National Pension Scheme

The various features of National Pension Scheme

- Since it is a low investment option, it, therefore, offers a transparency to the subscriber. The subscribers can freely choose their own pension fund schemes, where they can have an idea of how the investment is doing on a routine basis.

- The process is very simple, as the account is opened at the respective Nodal Office and acquire a PRAN.

- As the employees are provided with unique PRAN’s, therefore, they are recognized by the same PRAN all over the country, no matter they stay in which part of India.

- The subscribers can access to the details pertaining to the NPS Online.

- The NPS offers a wide variety of options to choose from, which includes Pension Fund Managers.

- They also provide the flexibility to switch between the fund managers and investment options.

- The subscriber is free to change the contribution amount and contribution frequency at any point in time.

- It is a low-cost investment option with low management fund charges.

Advantages of the NPS Scheme

- The NPS offers a wide range of investment options and choice of Pension Fund Managers. This will lead to the growth of the investments and the individuals have the choice to switch over to any investment option they want.

- The NPS provides effortless portability across the jobs and locations.

- It provides Dual Benefit of low cost and power compounding. The account maintenance cost is inexpensive compared to the other pension products available in India.

- It is a safe retirement fund introduced by the Government of India and regulated by PFRDA.

- Tax Benefits under the NPS Scheme:

- Section 80C Deduction: Your Contribution is eligible for the deduction under the Section 80C up to a maximum limit of Rs 1.5 Lakh.

- Additional Rs 50, 000 benefit under Section 80CCD (1B): There is an additional deduction of Rs 50, 000 available for the financial year 2015-16 under the Section 80CCD (1B). This means that you can claim up to Rs 1.5 Lakhs and an additional benefit of Rs 50, 000.

Charges Levied by POPs and CRAs

- In case of the Tier-I accounts, the employer has to pay all the fees and charges and in case of the Tier-II accounts, the subscriber has to pay for all the transactional and activational charges.

- The CRA (Centralized Record Keeping Agency) levies the following fees and charges:

- PRA account opening charges are Rs 50.

- PRA account maintenance charges are Rs 190 per year. The transaction fees are Rs 4 per transaction.

- The POP levies the following fees and charges:

- The registration fees cost Rs 100. 0.25% of the initial amount is contributed by the subscriber for the contribution upload as well as any transactions related to the contribution uploads.

- If any transaction is made where the contribution is not made by the subscriber- Rs20.

- These fees are chargeable from the date of joining.

Procedure to Check Balance in National Pension Scheme Statement Online

Following are the step by step procedure to check balance in Tier-I and Tier-II accounts in the National Pension Scheme Statement Online:

- Firstly, open the main website of the CRA and NSDL, via the following link: http://cra-nsdl.com/CRA/

- Log in as the subscriber to access the balance details under the NPS.

- Now login using your User ID and password which is the PRAN number allocated by the NSDL to each individual subscriber.

- Following the login procedure, go to the “Views” tab shown under that particular transaction statement.

- This will provide all the details regarding where the money is invested as well as the fund managers appointed to manage his investments.

- The subscribers can also check the aggregate amount that has been invested by both himself as well as the Government, including any returns.

- Tier-II balance details can be accessed by heading to the “Account details” section which is shown at the bottom.

Rules Regarding the Withdrawals from the National Pension Scheme

Withdrawal from the NPS is allowed by the PFRDA only under the following conditions:

- If 40% of the accumulated pension of the subscriber is used for the purchase of the annuities, then the remaining accumulated pension is given to the subscriber in the form of the lump sum.

- In case of the death event of the subscriber, the total pension that the subscriber has accumulated will be given to the nominee.

- If a minimum of 40% of the accumulated pension of the subscriber is used for the purchase of the annuities then the remaining amount will be given to the subscriber in the form of the lump sum.

The main rules regarding the withdrawals from both Tier-I and Tier-II Accounts are:

Withdrawal from Tier-I Accounts

If the subscriber should complete the service within 15 years, then he/she is eligible to make withdrawals before maturity. If the subscriber completes the service of 25 years, then he/she can make withdrawals up to 50% of his/her contribution. These withdrawals are made in emergency cases only.

Withdrawal from Tier-II Accounts

There are no restrictions regarding the withdrawals on the Tier-II accounts. The subscribers are free to make withdrawals whenever and wherever they want to.

Premature Withdrawal from NPS for both Tier-I and Tier-II Accounts

There are a number of rules and regulations regarding the premature withdrawal from NPS for both Tier-I and Tier-II accounts are concerned:

- The subscriber is allowed to make partial withdrawal about a maximum of 25% of the contribution.

- Only three premature withdrawals are allowed per subscriber.

- To be eligible for the premature withdrawals, the subscriber must have made a contribution towards NPS for at least 10 years.

- In an emergency case, such as sickness or any health related issues premature withdrawals are allowed for the treatment expense.

- The premature withdrawals can also be applicable for the education and marital expenses.

- If the subscriber is buying a new house for the first time, then he/she can use the premature withdrawals.

Procedure and Documentation required to make Withdrawals from the NPS

If a subscriber wants to stop making the contributions to the NPS, then he/she has filled in the withdrawal application form and submit to his or her respective Point of Presence.

Following are the documents that are required to make withdrawals from the NPS:

- Original PAN Card

- Identity Proof such as Passport, PAN Card, Driver’s License etc.

- Address Proof such as Passport, Voter ID, Aadhaar Card etc.

- Bank certificates or the cancelled cheque that contain the name of the subscriber as well as his bank account number with the IFSC Code(check IFSC code here).

All the documents are authenticated and the Point of Presence (POP) will send them to the CRA and NSDL. The CRA ensures that the claim is registered and all the documents and forms are submitted.

Later the CRA will ensure that the application is processed and the account is settled.

National Pension Scheme Withdrawal Form Types

The National Pension Scheme Withdrawal Forms are categorized into three types:

- Employees of the Government

- Subscribers belonging to the Government

- Swavalamban or unorganized sector subscribers

Withdrawal Forms for the Government Employees

Form 101GS: The Government employees can avail this form to withdraw the accumulated pension following their retirement.

Form 102 GP: The Government service employees can avail this form to withdraw their accumulated pension before their time of retirement.

Form 103 GD: The Nominee or any legal heir of an employee with the Government who is the part of the NPS can avail this form in order to claim the pension that is accumulated in the account of the subscriber.

Withdrawal Forms for the Corporate Subscribers

Form 301: The corporate employees, as well as the individuals who opt for the withdrawal of their total accumulated pension following retirement, can use this form.

Form 302: The corporate employees, as well as the other individuals and the citizens, can opt for the withdrawal of the accumulated pension before the retirement can use this form.

Form 303: The Nominees or any legal heir of a corporate employee can avail this form to claim this accumulated pension of the subscriber.

Withdrawal Forms for the Swavalamban Subscribers

Form 501: If the subscriber is a part of the Swavalamban, then he/she can use this form to make the withdrawals of their total accumulated pension following their retirement.

Form 502: If any subscriber is a part of the Swavalamban then, he/she can use this form to make withdrawals of the total accumulated pension after the retirement.

Form 503: If any Nominee of the person who is the part of the Swavalamban can use this form to claim the accumulated pension of the subscriber.

Death Benefits Provided Under the National Pension Scheme

According to the guidelines of the National Pension Scheme, the nominee of the subscriber is allowed to withdraw, as a lump sum, if the total amount that is accumulated in the account of the subscriber in case of the death event of the subscriber.

The following documents are required as the Nominee, to make the withdrawal from the subscriber’s account.

- The relevant form that is related to the withdrawal of the amount.

- The PRAN Card in original

- A cancelled cheque showing the relevant details of the Nominee like the bank accounts with IFSC Codes

- The Subscriber’s death certificate.

- Any document or the certificate that proves the claiming the amount is the legal nominee or heir of the subscriber.

- The ID as well as the Proof of Address of the Nominee.

NPS Scheme has one additional account which is called as the Swavalamban Account.

Swavalamban Account: In this account, the Indian Government deposits a sum of Rs 1000 every year over the initial four years. The aim of introducing this account is to provide an encouragement for the workers and the low-income groups.

Swavalamban Pension Yojana or NPS-Lite

The main objective of this Yojana is to help the people who are financially and economically backwards. These schemes aim is to secure their future. The NPS-Lite scheme is based on the servicing of the groups as a whole and on low charges. The organizations called as the “Aggregator’s” will take the charge of the people who belong to these particular groups and provide them assistance with the process of registration, transfers, maintenance of the Pension contributions. The subscribers aged between 18-60 years can join and make contributions.

According to the scheme, the Government deposits a fund amount of Rs 1000 to each individual’s NPS account for the initial four years after the opening of the account in the year 2010-11. Currently, the Atal Pension Yojana has replaced this scheme where any subscriber whose age is less than 40 years is eligible to receive a pension amount up to Rs 5000, once he/she attains an age of 60 years.

Features of Swavalamban Pension Yojana or NPS Lite

- A PRAN card is allotted to every subscriber who comes under this scheme.

- The contributions are made monthly, of any amount.

- As per the Guidelines set by the Government, 85% of funds are invested in the debt securities and 15% of the funds are invested in the equity.

- The fund managers of this scheme are ICICI, Kotak, IDFC, SBI, Reliance, and UTI. The subscriber can choose any one of these.

- The aggregators will receive the account statements, that is the history of all the transactions that take place and this transaction statement is later distributed to the subscribers in monthly basis.

Comparison between the New Pension Scheme and the National Pension Scheme – Highlights

| Features | National Pension Scheme | New Pension Scheme |

|

Contribution By Employees |

The individual has to contribute 10% of his/her total Special Pay, Basic Pay and all other allowances that combine to make up Provident Fund. | Includes all the allowances that is mentioned is the National Pension Scheme along with Dearness Allowance. |

|

Contribution by the Bank |

The Bank’s contribution will match the contribution of the employee, a separate account is created under the NPS to collect the funds. | In new pension scheme, the contribution of both the parties is collected in one account. |

|

Employee’s Additional Contribution |

The Contributions made under the National Pension Scheme can be stopped by the employees by sending an advance notification before a month. |

This scheme allows withdrawals and schemes at any point in time. |

|

Management of Funds |

This scheme was managed by the Provident Fund Scheme |

The PFRDA appoints six fund managers to control and manage the account. |

|

Scope of Regulation |

No such body exists at the Nationwide Level |

PFRDA is the authorized body for this scheme. |

|

Levy of Charges |

No extra fees are charged to the subscribers | Some fixed and variable charges are levied under the New Pension Scheme. |

Transfer PF Balance When Changing Job – Whole Process Form 11

EPF (Employees Provident Fund) scheme is a retirement savings scheme for employees across India. In this scheme, a small portion of your salary is deducted from your salary account to your EPF account. Over a time it grows into a corpus which can be handy at the time of the emergencies.

Earlier if an employee switches their jobs they had to open a new EPF account with the company and submit an application to the new company to transfer the previous balance in new account. And as this was very inconvenient especially when one had to switch job frequently, the employees either used to avoid the whole process or withdraw their EPF account.

However, with the new initiative taken by the EPFO (Employees Provident Fund Organization), your EPF account will be automatically transferred in case you switch your job. Hence, it becomes easy and very convenient for people who change their jobs frequently.

How to Check EPF Balance Online

This was communicated by the Central Provident Fund Commissioner in an order stating the revision of the transfer procedure.

Offline and Online method of EPF accumulation after changing jobs

Offline Process

In case your Aadhaar number is not linked with your PF account or with UAN (Universal Account Number) or the verification is still pending with the previous employer, you have to go with the offline procedure, as online procedure is not available in such cases.

For offline process of EPF accumulation, you have to get Form 13 (you can get it from your employer or you can download it by clicking here) fill the form properly and submit it to your new employee. Followed by the employer who is required to forward this application to EPFO office and PF will transferred in due course.

Also note, in the offline transfer the attestation of both the previous and the new employer is required.

Online Process

In an online process, an employee is required to fill up the Composite Declaration Form (F – 11 Click here to download) with the details about their previous PF account and UAN, when they join a new company and submit it to their new employer.

The new employer is then required to update these details on the employers portal at EPFO

In case the UAN and PF account is linked with your Aadhaar number it will proceed with auto – transfer process.

Once done, an SMS will be sent on employees mobile phone number informing the same.

Check Here – How to link Aadhaar with EPF Account.

How to Login to EPFO Member Portal

EPFO stands for Employees Provident Fund Organization. It is a statutory body under the Ministry of Labour and Employment, Government of India. The Organization was founded on 4th of March 1952.

The Organization offers special services such as:

- Employees Provident Scheme 1952

- Employees Deposit Linked Insurance, Scheme 1976

- Employees Pension Scheme 1995

Member Portal of EPFO

The link for the online portal of the EPFO is members.epfoservices.in. The portal provides all the information and services which are related to the Employees Provident Fund.

To experience the services such as checking your EPF balance etc. you need to log in to the portal and ask for the permission to access the online EPF Account Passbook.

How to Login to the EPFO Member Portal

Follow the below given steps to log in to the EPFO Member Portal:

- Visit the EPFO Member Portal: unifiedportal-mem.epfindia.gov.in.

EPF Member Login - In the main page for the registration, fill in the required details.

- Ensure that you enter the correct documents type since you will have to log in to the portal using the same details provided by you.

- After the registration process, log in to the EPFO Member Portal. If you wish to register into the portal with the help of the PAN Card, you will have to select the PAN Number from the tab mentioning “Select Any One Document” and enter your PAN Number.

- Now check the details before submitting, to get the PIN Number.

- After the submission of the details, you will get an authorization PIN.

- Now enter the authorization PIN, and you will be registered.

- From the above-mentioned steps, you can now easily open the member portal by entering the specific details such as the mobile number, document type, and document number and successfully download your EPF Passbook from the website.

EPFO Member Portal: (Things to Remember)

- You can use only one mobile number during the process of registration.

- You can add multiple id numbers, and you can use anyone with your mobile number to login to the EPFO Member Portal.

- After registering yourself, you can be able to view your EPF Passbook. It is to be noted that you will be able to use this facility only if your employer has uploaded the electronic challan cum return from the wage month May 2012 onwards.

- Being a registered member, you can only view one account under one employer. If you have more than one account with one employer then you should apply for a transfer by filling in the required details in Form 11.

- You will be able to view 10 accounts under different organizations (establishments). There is no restriction on the number of times you view all the accounts.

- You don’t have to create any User ID or Password. You just need your registered mobile number and anyone identification proof (Aadhaar/ PAN/ National Population Register/ Voter ID/ Driving License/ Passport) to register and Log in.

- If in case you wish to view the inoperative accounts, you need to make one official request for using the facility to display the inoperative accounts.

- It is, however, important to note that the facility is not available to the current members of the organizations (establishments) which have an exemption as per EPF Scheme 1952.

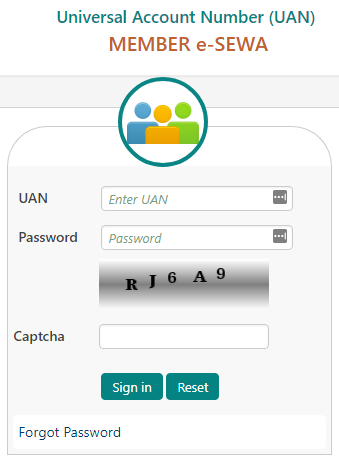

UAN Portal

Prime Minister Narendra Modi has introduced the Universal Account Number (UAN) which is a 12-digit unique number to facilitate Provident Fund (PF) number portability. The UAN Number is allotted to the employee who is contributing to the EPF and will be generated for each of the PF Member by EPFO. The link to access the EPFO’s Universal Account Number (UAN) Member Portal is – unifiedportal-mem.epfindia.gov.in

This offers several facilities via one single window.

UAN Umbrella

The UAN acts as an umbrella for the several individuals working under different organizations or establishments. UAN, therefore, links a multiple Member Identification Numbers of one Member. If you have been already allotted with a Universal Account Number (UAN), then you have to give the same to the new employer so the latter can mark the new Member ID to the allotted UAN.

You need to contact your Organization to get your UAN. After that, activate your registration to access different facilities such as the downloading of the UAN card, Updating of the KYC Details and much more.