Home » Investment » EPF

Category Archives: EPF

How To Check EPF Balance In 2019 | Online

The EPF Balance is the balance that is present in the Employer’s Provident Fund (EPF) Account. The EPF Balance is nothing but the balance that is deducted every month from your salary along with an amount that is contributed to your EPF Account by your employer. Opening an EPF can be a very good idea for retirement savings.

The Employer’s Provident Fund launched an online inquiry platform in the year 2013. This online portal was launched in order to check the fund balance. The main objective of this portal is to provide a quick access to the customers who want to check their PF Balance online. This is a very important factor for any salaried employee. Checking PF Balance online can provide the customer’s current updates about the information of their accounts, doing this will be very helpful for those who wish to make partial withdrawals or to avail any Loan.

The EPFO (Employee’s Provident Fund Organization) has introduced different ways to check the EPF Balance.

The following ways to check the EPF Balance are:

- Via SMS

- Via Missed Call

- Through Online Via UAN

- Via the Mobile App

Earlier, when these services were not available, check the EPF Balance was tuff and complex. There was a number of forms which were needed to be filled, and people had to wait in the queues for hours and hours outside the office. In this article, we are going to learn about these methods in details.

How to Check EPF Balance IN 2018 Online

The EPFO has provided numbers of facilities to their customers. Recently, the EPF Balance can also be checked through online. Below are the steps to check the EPF Balance Online:

- For checking your EPF Balance, you need to make sure that you have your EPF Account number with you. This is the most important thing to keep in mind before you start to perform any activity.

- Open the link – epfindia.com and click on the “Know Your Balance” which is located at the bottom of the page.

- Select the state of the PF Office in which your EPF Account is maintained.

- After you select the EPF State, a list of offices pertaining to that state will be listed down below.

- Choose your city, EPF Office from the list. For example: If your PF State Office is Karnataka and the Local Office is in Bangalore, then select Bangalore as the city.

- Now enter your EPF Account number, your name as mentioned in the EPF Records and your Mobile Number.

- The format of the EPF Number is TN/MAS/0054232/000/0000222. If in case there are no three digits present in the middle is not present in your EPF Account then you can leave the box blank and proceed further. The first two alphabets are the code of the region and the next three alphabets are the code of the PF Office.

- Now click on submit and the EPF Balance will be sent to you through an SMS on the registered mobile number.

How to Check EPF Balance via UAN

UAN is also called as Universal Account Number which is allotted by EPFO. It is a Universal Account Number which is unique for all the individuals who have enrolled under the EPF Scheme. The UAN number does not change even if you change your Employer or PF account number. This number is assigned to each employee. This number can be generated by logging in the EPF Website. Once you have registered for UAN, you will automatically receive the details like EPF Balance etc. on your registered mobile via SMS.

The steps for checking an EPF Balance via UAN are as follows

- Open the webpage- uanmembers.epfoservices.in

- Enter your Universal Account Number (UAN).

- Enter the mobile number where you want to receive the SMS.

- Select the EPF State and choose the city-specific EPF Office from the list. For example, if your PF State Office is Karnataka and the Local Office is in Bangalore, then select Bangalore as the city.

- Fill in the captcha code and you will receive a Pin and all the EPF Balance details are sent to the mobile number.

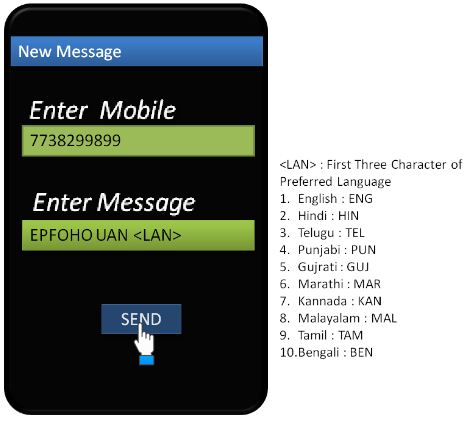

How to Check EPF Balance Via SMS or Missed Call

You can also check your EPF Balance through SMS or Missed Call. For this activity, you need to have an activated UAN Number. If you have a valid UAN Number then your mobile number is also registered with the EPF Department. You just have to give a missed call to 011-22901406 and you will receive an SMS that consists of the details of your PF Number, Age, and Name etc. In order to know your EPF Balance then you need to produce your UAN along with the Aadhaar Number or PAN Number.

To know your EPF Balance, KYC Details along with the UAN is mandatory. Once your UAN is integrated with your KYC, every time to give a missed call to the EPF Department, you will receive an SMS with the EPF Details along with the EPF Balance.

How to Check EPF Balance Through the Mobile App

The EPFO has recently launched a Mobile App for PF Balance tracking. The Mobile App serves different services such as the balance check as well as the Passbook Statement. This app is currently not available on the Google Play, so you can download it manually from the EPFO Official Website. Currently, this mobile app can only be used by the Android Users. The EPFO Department has been developing the app services for the Blackberry and IOS Devices.

On the EPFO App link, click and check the save target as. Once the app is installed on your device then open and feed your name and account number and track your PF Status. You can also download this file I the computer and later transfer it to the mobile phone. The file format is named as m-epf.apk and will be shown on your desktop or mobile wherever you want to download it.

Below are the steps to check the EPF Balance via Mobile App

- Open the Mobile App on the device and click on the Member Option.

Checking EPF balance using m-epf app - Under the Member Option there is an option available called as click balance/passbook and then enter your 12-digit UAN Number also enter your registered mobile number. The system will now verify your mobile number. If the number does not match then the UAN Number will display an error.

- If in case the Mobile Number and the UAN Combination is correct then it will display a message of your updated EPF Balance information along with the personal details (name, date of Birth, Aadhaar Number, PAN for tax Deductions, Last Month EPF Contribution etc.) that are present in your EPF Records.

- If in case you want to see your EPF Statement for the last 7 months, then you can select the option of “View Passbook” option and get a detailed statement.

The EPF Mobile App is good for EPF Balance Tracking and is the handy tool for checking the EPF Balance.

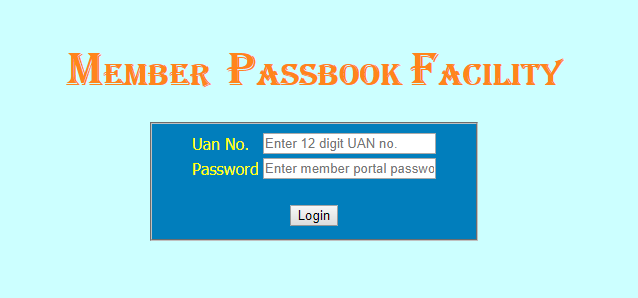

How to Access and Download EPF Passbook

The EPF Passbook is quite similar to that of the Bank Accounts Passbook. The Passbook carries the history of all the transactions including both the deposits and or any partial withdrawals. Below mentioned are the different modes through which you can access and download an EPF Passbook.

Using the UAN Portal

UAN can be used to download the EPF Passbook online from the EPFO Website and you can also track down the status of your EPF Transactions. The EPF Passbook has certain particulars regarding the Monthly PF Contribution from your employer and the contribution towards the pension scheme as well as the latest EPF Scheme. The EPF Passbook is like a full statement of all your transactions with the EPFO.

The only prerequisite for obtaining this passbook is to generate the UAN number, for which you can later Login and then download it.

Using the Member Portal

The EPFO has a member portal from where you can register online and view their Passbook transactions. This facility can be availed by the individuals whose employer has uploaded the Electronic Challan cum Return for the salary month of May 2012 and beyond.

The advantage of using a member portal is that you don’t have to remember any user name or Password. You just require only the registered mobile number and any identity proof like PAN, Aadhaar etc.

You can also feed multiple number of IDs along with the registered mobile number. Any of these ID Numbers can be used with the combination of the Phone number for the retrieval of the EPF Statement via EPF Passbook.

Thus these two portals can be used for accessing and downloading the EPF Passbook.

Points To Keep In Mind While Checking an EPF Balance

There are certain points that should be kept in mind while checking an EPF Balance are as follows:

- Only one mobile number is allowed for the registration at the member portal, for downloading a passbook.

- Any registered mobile number can view only one EPF account details, and for viewing more accounts, you will require a number of mobile numbers registered. You will need to file Form 13 for this process.

- One member is allowed to vie maximum 10 EPF Account balances.

- Multiple ID numbers can be added one after another during the process of registration so as to make use of the identity proof number during the time of the registration.

So, hope you have got enough of information regarding what is EPF, how can check the EPF Balance through different ways and the ways to access and download an EPF Passbook. Now, there must be some questions rising on your head such as, if there is a way to check the EPF Balance online, then there also must be a way to transfer the funds in EPF. Definitely, you can transfer the funds to EPF. Let’s see how, but before jumping to the topic, let’s understand what an EPF Balance Transfer is and why we need it?

EPF Balance Transfer

Did it ever happen that you’ve switched your jobs a multiple number of times and your provident funds have been resting in the accounts? Maximum of the answer would be a “Yes”. It has been seen that people usually forget to transfer their EPF Balance on time. Changing a job comprises multiple numbers of paper works and procedures and quite apparently, there is a swirl of confusions when it comes to the matters related to the EPF. Provident Funds provides a lot of benefits than the fixed deposits and other Government Bonds, so it is preferable to transfer the amount whenever you are switching a job. However, the employees also have an option to close their active EPF account and open a new one. Thus, undoubtedly EPF is known as the best long-term saving option that provides ensured income and saves your tax.

Features of EPF Balance

- The Employees can transfer their accumulated balance anytime from one account to another. But this funds cannot be transferred to a third person account.

- Along with the provident fund, the pension amount under Employee Pension Scheme (EPS) also gets deposited in the Employee’s new account. But for availing these benefits, the Government has mandated of having a minimum of 6 months of the work period.

- For the fund transfer to take effect, both the EPF account must have all the essential information such as the employee’s name, father’s name, date of birth etc. any mismatch or unavailability of information can lead to the rejection of the transfer request.

- The employees cannot transfer a portion of the EPF Funds to the new account and keep a few in the old account. The entire sum has to be deposited to the new account.

- The EPFO has launched an online submission system to facilitate the transfer of the provident funds. For the withdrawal of the EPF amount, the members can apply through their current or previous employer.

Note

EPF Contributions at the Rate of 10%

A PF of 10% interest is applicable to the people who are working under the following establishments:

- A company with less than 20 employees on its payroll.

- Any organization that suffers losses equal to its entire net worth.

- Establishments coming under Jute, Beedi, Brick, Coir and Guar Gum Industries.

- Any other establishments decided by the Board of the Industrial and Financial Reconstruction.

EPF Balance for the Inoperative Accounts

According to the notification issued by the Government in the year 2016, the inoperative accounts will build up interests and will not be classified as Inoperative anymore. Earlier the EPFO has stopped paying interests to the dormant accounts. But after the release of the new amendment, all the inoperative accounts will receive interests at 8.8% per annum. There are basically two reasons why the accounts were getting inoperative- firstly, due to the cumbersome process while EPF Transfer and people switching jobs frequently and opening new accounts.

New EPF Withdrawal Forms for Easy Claims

As we have mentioned it earlier, the EPFO has released new forms that facilitate the withdrawal procedures of the Provident Fund Amount without the employer attestation. These forms are Form 19 UAN, Form 10C UAN and Form 31 UAN. We have already discussed the Form 10C in the above section. Due to the introduction of these forms, the procedures have been minimized while making claims and EPF Transfers. By using these new forms, the individuals can apply for Final Claim Settlement, Full Withdrawal, Partial Withdrawal, and Loans. Form 19 UAN is applied if an employee wants to resign from the service or the employer terminates the employment agreement. Form 10C UAN is used for making claims related to EPS and Form 31 is used for making partial withdrawals or advances. The preconditions for the EPF Withdrawal without an employment signature are as follows:

- Form 11 of the employee must be available in the EPFO records.

- He/she must have a valid UAN

- The bank details and the Aadhaar must be available in the KYC Data.

If the employee does not fit the above criteria, then he/she will have to make claims using the regular EPF Forms:

| Form 19 | Click to Download |

| Form 10C | Click to Download |

| Form 31 | Click to Download |

Provident Fund Rules for the Railway Employees

A Railway Employee contributes 8.5% of his/her salary towards the State Railway Provident Fund. The EPF Balance of the Railway Employees is maintained by the Railway Accounts Department.

Name Mismatch in the EPF Account

If in case your name is misspelled incorrectly in the EPF account, then the procedure to rectify it is quite easy.

- All you have to do is submit an EPF name correction form along with the employer’s statement and other supporting documents such as PAN Card, Aadhaar Card, Voter ID Card or Bank account Passbook.

- The name change application should be addressed to the EPFO Commissioner specifying the errors that are found in the existing employee credentials.

Currently, the EPFO is working on the portal and is introducing to report the problems online. This web portal is still in the testing stage. Once the web portal is implemented, people can log in through their UAN and submit an online application for the name correction.

EPFO Customer Care

The sites are handled for 24 hours by the Officials of the regional centers. You can also visit the nearest EPFO Centers to get the information related to your account.

Tax Deductions for EPF Accounts with or Without PAN

The Indian Government has introduced a new section in the Finance Act 2015, whereby PF withdrawals will be subjected to the tax deductions. As per the new rule, all the withdrawals over Rs 50, 000 will be taxable at source if the employee has served less than 5 years. Even the individuals below the taxable income range will have to ante up 34% towards “PF Withdrawal tax”. However, if the EPF Account is linked with the PAN, then the rate of the deductions will be 10% per annum and the rate of interest without PAN will be 34.6% per annum. If an EPF member has filed Form 15G and H at the time of joining then the tax of deductions are not applicable for the withdrawals below Rs 2, 50, 000. If the PF amounts are withdrawn for health purpose or business failure or any such emergencies then, the tax deductions are exempted. Therefore, it is ideal that you save your taxes by securing your EPF Balance with PAN Number.

EPFO Digital Signature for Employers

The Centers have urged to all the organizations which are under the EPF Scheme has to apply for the digital signature. Doing this can lead an easy verification of UAN Data. The employers can upload their digital signature through Online Transfer Claim Portal (OTCP) of EPFO.

How to Download EPF Balance Slips

At the end of the salary period, the annual statements of the PF accounts are published on the EPFO website. This can be downloaded by the users/employers through the E-Sewa Portal. The step by step process to download the EPF Balance Statement are:

- Type the following URL in your webpage- epfindia.gov.in

- In the EPFO homepage, click on the link “For Employers”.

- From the services listed, select the “ECR/Challan Submission”.

- This will redirect to the “Employer E-Sewa” page.

- Click on the “Employer E-Sewa” link given on the page and sign in using the credentials.

- In downloads tab, select download PF Slips and choose your desired location and save it in PDF.

The EPFO is expecting to launch a massive drive throughout the country with an aim to increase maximum member enrollments. The Government has also issued different guidelines on the PF Settlements under which the death claims will be settled within 7 days from the date of the application and retirement claims before the date of the retirement.

Thus, the Employee Provident Fund provides a social security to all the employees who pay in the present and reap benefits in the future.

Transfer PF Balance When Changing Job – Whole Process Form 11

EPF (Employees Provident Fund) scheme is a retirement savings scheme for employees across India. In this scheme, a small portion of your salary is deducted from your salary account to your EPF account. Over a time it grows into a corpus which can be handy at the time of the emergencies.

Earlier if an employee switches their jobs they had to open a new EPF account with the company and submit an application to the new company to transfer the previous balance in new account. And as this was very inconvenient especially when one had to switch job frequently, the employees either used to avoid the whole process or withdraw their EPF account.

However, with the new initiative taken by the EPFO (Employees Provident Fund Organization), your EPF account will be automatically transferred in case you switch your job. Hence, it becomes easy and very convenient for people who change their jobs frequently.

How to Check EPF Balance Online

This was communicated by the Central Provident Fund Commissioner in an order stating the revision of the transfer procedure.

Offline and Online method of EPF accumulation after changing jobs

Offline Process

In case your Aadhaar number is not linked with your PF account or with UAN (Universal Account Number) or the verification is still pending with the previous employer, you have to go with the offline procedure, as online procedure is not available in such cases.

For offline process of EPF accumulation, you have to get Form 13 (you can get it from your employer or you can download it by clicking here) fill the form properly and submit it to your new employee. Followed by the employer who is required to forward this application to EPFO office and PF will transferred in due course.

Also note, in the offline transfer the attestation of both the previous and the new employer is required.

Online Process

In an online process, an employee is required to fill up the Composite Declaration Form (F – 11 Click here to download) with the details about their previous PF account and UAN, when they join a new company and submit it to their new employer.

The new employer is then required to update these details on the employers portal at EPFO

In case the UAN and PF account is linked with your Aadhaar number it will proceed with auto – transfer process.

Once done, an SMS will be sent on employees mobile phone number informing the same.

Check Here – How to link Aadhaar with EPF Account.

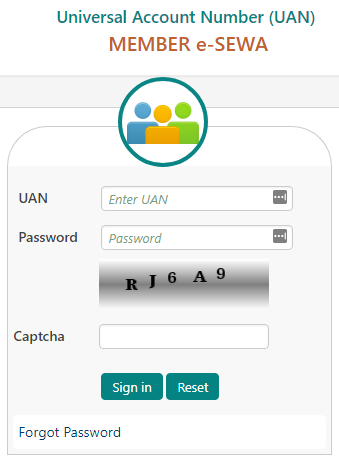

How to Login to EPFO Member Portal

EPFO stands for Employees Provident Fund Organization. It is a statutory body under the Ministry of Labour and Employment, Government of India. The Organization was founded on 4th of March 1952.

The Organization offers special services such as:

- Employees Provident Scheme 1952

- Employees Deposit Linked Insurance, Scheme 1976

- Employees Pension Scheme 1995

Member Portal of EPFO

The link for the online portal of the EPFO is members.epfoservices.in. The portal provides all the information and services which are related to the Employees Provident Fund.

To experience the services such as checking your EPF balance etc. you need to log in to the portal and ask for the permission to access the online EPF Account Passbook.

How to Login to the EPFO Member Portal

Follow the below given steps to log in to the EPFO Member Portal:

- Visit the EPFO Member Portal: unifiedportal-mem.epfindia.gov.in.

EPF Member Login - In the main page for the registration, fill in the required details.

- Ensure that you enter the correct documents type since you will have to log in to the portal using the same details provided by you.

- After the registration process, log in to the EPFO Member Portal. If you wish to register into the portal with the help of the PAN Card, you will have to select the PAN Number from the tab mentioning “Select Any One Document” and enter your PAN Number.

- Now check the details before submitting, to get the PIN Number.

- After the submission of the details, you will get an authorization PIN.

- Now enter the authorization PIN, and you will be registered.

- From the above-mentioned steps, you can now easily open the member portal by entering the specific details such as the mobile number, document type, and document number and successfully download your EPF Passbook from the website.

EPFO Member Portal: (Things to Remember)

- You can use only one mobile number during the process of registration.

- You can add multiple id numbers, and you can use anyone with your mobile number to login to the EPFO Member Portal.

- After registering yourself, you can be able to view your EPF Passbook. It is to be noted that you will be able to use this facility only if your employer has uploaded the electronic challan cum return from the wage month May 2012 onwards.

- Being a registered member, you can only view one account under one employer. If you have more than one account with one employer then you should apply for a transfer by filling in the required details in Form 11.

- You will be able to view 10 accounts under different organizations (establishments). There is no restriction on the number of times you view all the accounts.

- You don’t have to create any User ID or Password. You just need your registered mobile number and anyone identification proof (Aadhaar/ PAN/ National Population Register/ Voter ID/ Driving License/ Passport) to register and Log in.

- If in case you wish to view the inoperative accounts, you need to make one official request for using the facility to display the inoperative accounts.

- It is, however, important to note that the facility is not available to the current members of the organizations (establishments) which have an exemption as per EPF Scheme 1952.

UAN Portal

Prime Minister Narendra Modi has introduced the Universal Account Number (UAN) which is a 12-digit unique number to facilitate Provident Fund (PF) number portability. The UAN Number is allotted to the employee who is contributing to the EPF and will be generated for each of the PF Member by EPFO. The link to access the EPFO’s Universal Account Number (UAN) Member Portal is – unifiedportal-mem.epfindia.gov.in

This offers several facilities via one single window.

UAN Umbrella

The UAN acts as an umbrella for the several individuals working under different organizations or establishments. UAN, therefore, links a multiple Member Identification Numbers of one Member. If you have been already allotted with a Universal Account Number (UAN), then you have to give the same to the new employer so the latter can mark the new Member ID to the allotted UAN.

You need to contact your Organization to get your UAN. After that, activate your registration to access different facilities such as the downloading of the UAN card, Updating of the KYC Details and much more.

Employee Provident Fund (EPF) Transfer Via Unified Portal

The Employee Provident Fund(EPF) brings in a number of new measures to improvise online claim process. By inventing different methods for easy online streamline like for example ‘online transfer claim’ got replaced by United Portal of the EPFO. The online transfer PF claims were available since ages but now if a person wants to transfer any claims he or she will have to proceed via the ‘unified portal’.

Every employee is provided with a Unique Identity Number. This acts as an umbrella for a number of PF accounts. Earlier when an employee had to change his or her job he had to go through a time-consuming process of linking his old PF account to the new one but now with UAN, all an employee has to do is provide his UAN number to his or her new employer. As a person changes his or her job, the UAN acts as the umbrella of all the past PF accounts as well as the new one.

Things to Remember Before Using the Unified Portal:-

You need to keep your UAN number with you.

- Make sure that your UAN is seeded with KYC(bank details and Aadhaar)

- Provide the approved/verified KYC to your new employer.

- Log in to the official unified portal

- After logging in click e-sewa

- Click on ‘online services’ and then click ‘transfer request’

- Fill the transfer claim form online and then download the form in PDF format

- Take a print out of the form and then submit it to your employer after signing it(within 10 days).

- After receiving the form the employer approves the transfer digitally by accessing the employer interface in the Unified Portal.

Another initiative by the EPFO to ensure the convenience of the employer is that it has reduced the time of withdrawal to 5 days.

Transfer Post 1st of May:-

In order to ensure EPS benefit of the employees, the EPFO has directed to clear all in-process claims within the month.For this, the employer is required to take out a print out of the transfer claim and get it signed by the employee.Thus an employee who has initiated a transfer post 1 March is required to resubmit the claim.The date of joining and the date of leaving should be correct and there should not be any mismatch to ensure a smooth process.After attesting it from the employee the employer sends it to EPFO office to start the process.

Transfer/Withdraw:-

After leaving an organization a person might be confused with whether to withdraw or to transfer the amount to the new employer.The following things should be kept in mind while transferring:-

- A person has the option to withdraw if he or she remains unemployed for 60 days( the withdrawal is not taxable if a person has served five years continuous service).

- If a person has worked at a particular place and has shifted his job to another organization then it is more advisable to transfer the existing PF to the new employer.

- It must also be kept in mind that monthly salary to EPF is necessary as 12% of monthly salary is moved to EPF.

The EPF is not only a saving scheme but also ensures a financial base for the employees after retirement.

To know more about EPF please visit the Unified Portal.

EPFO makes online claims must for PF withdrawals above Rs 10 lakh

Employees’ Provident Fund Organization or EPFO which is a retirement fund body is mandatory to file online claims for provident fund withdrawals above Rs. 10 lakh, which is another step towards becoming a paperless organisation.

The EPF account holders are also required to file online claims for withdrawals of above Rs 5 lakh under the Employees Pension Scheme 1995 which has been mandated by the Employees’ Provident Fund Organizations (EPFO).

EPFO offers both the option of filing online as well as manual claims for provident fund withdrawal as also for pension to the EPF subscribers.

This decision of filing online claims for withdrawal of certain amount of money has been taken at a meeting chaired by Central Provident Fund Commissioner on January 17, 2018, said by an official

The official also said that

They also added that

Also note that the EPF account is required to be linked and verified in the system before the online claims can be settled. Also, the subscriber is required to have an activated universal account number.

And as per the rules, the claims exceeding the said limit would not be accepted in the physical form now onwards.

At present, the EPFO has over 6 crore subscribers and a corpus of Rs 10 lakh crore.

EPFO offers new facility for the citizens to generate UAN (Universal Account Number) easily. UAN is a 12 digit unique number which is allotted to every member of EPF (Employees’ Provident Fund), which helps the employee to keep a check of his EPF account.

To know more about it you can also read here – EPFO