Home » Investment

Category Archives: Investment

PFRDA looking at ways for minors to open an account under NPS

PFRDA (Pension Fund Regulatory and Development Authority) is looking at ways for the minors to be able to open an account under the National Pension Scheme (NPS). The authority will also scrutinize the legal procedures and examine the legal aspects which are associated with the matter.

On the matter, Hemant Contractor, Chairman of PFRDA said

He also added that there are legal procedures involved for allowing minors to open such an account is concerned and the PFRDA is looking at ways to sort it out.

When asked about the time – span needed to have some light on the matter he said, PFRDA will forward this matter to the finance ministry once the internal discussion is done.

Further, he said

National Pension Scheme or NPS is a contribution pension scheme which is administered and regulated by the Pension Fund Regulatory and Development Authority (PFRDA) which is a body created by an act of Parliament. This scheme offers a large variety of investment options to its employees. And the main objective of the scheme is to lower the liabilities of the Government of India with regards to total pension as well as to ensure that the country’s citizens would earn a stable income following their retirement along with helping them earn decent returns on their investments.

And NPS is designed for the government as well as the private sector employee. And on the other hand, APY (Atal Pension Yojana) mainly caters to those belongs to the unorganized sector.

According to the sources, the complete subscriber base of the pension regulator was 1.81 crore as on 31st October this year. And there were 1.54 crore subscribers at the end of the fiscal ended March 2017.

Debt Mutual Funds – Types, Interest Rates, Eligibility Criteria

The Mutual Fund Schemes are the archives of the trusts and the investor’s hard earned money. These Debt Mutual Funds are unique in its own way as they are organized and operated by the people whose loyalty and the interest lies outside the enterprise. There are different types of Mutual Funds that invest in various securities depending upon their investing strategy.

The Debt Mutual Funds mainly invests in the fixed income securities issued by the Government and the companies. These fixed income securities include the corporate bonds, government securities, treasury bills, money market instruments are many more debt securities. The Debt securities have a fixed maturity date and pay a fixed rate of interest.

The Returns of the Debt Mutual Funds comprises of two basic factors:

- Interest Income

- Capital Appreciation/ Depreciation in the value of the security due to the changes in the market dynamics.

When you purchase an equity instrument such as stock, you buy the ownership into the company to be a participant in its growth. But when you buy a debt instrument then give a loan to the issuing body. The Government based companies and the private sector companies issue the bills and bonds to get a loan for running their operations. The interest that you have earned in these debt securities is pre-decided along with a time period after which the debt security will mature. This is the reason why the Debt Mutual Funds are called as the “Fixed Income Securities” because you know that what you will get in the return out of them.

The Debt Fund Investments invests in the fixed income securities, and like the equity funds, they advance the returns by diversifying across the different types of securities. This allows the debt funds to earn a decent return, but one demerit is that there is no guarantee of returns. However, the Debt Funds can be expected in a predictable range which makes them safer avenues for consecutive investors.

Different Types of Securities that Debt Funds Invest In

The Debt Funds mainly invest in different securities and have different credit ratings. The securities credit ratings denote the risk element associated with the entity that is issuing the security. A higher credit rating means that the entity is more interested in paying the interest on the debt security as well as the principal amount upon the maturity. This is why it is more preferable for the debt mutual funds to invest in the higher-rated securities as it will be more volatile in nature than the low-rated securities.

Another factor that denotes the types of securities that the debt funds invest in is the maturity of that security. There are many debt funds that invest in the securities that mature at different time periods. The shorter the maturity period the less volatile the debt security.

Types of Debt Mutual Funds

There are different types of Debt Mutual Funds. The basic differentiating factor between the debt funds is the “Maturity period” of the instruments they invest. Below are the types of the Debt Mutual Funds where one can choose according to their requirement.

- Dynamic Bond Funds

The Dynamic Bond Funds are the types of funds that are not fixed at a certain point of the maturity period. They are quite fluctuating by nature it is because these funds take an interest rate calls and invest in the instruments which have a longer or shorter maturity period.

- Income Funds

The Income Funds take a call on the interest rates and they invest in the debt securities which will be having different maturity periods, but most often these income funds invest in the securities that have a longer maturity. Due to this feature, these funds are more stable than the dynamic bond funds. The average maturity of the income fund is around 5-6 years.

- Short-Term and Ultra-Short Term Debt Funds

These are the debt funds that invest in the instruments that have shorter maturity period which ranges from a year to 3 years. The Short-Term funds are ideal for the conservative investors as these funds will not get affected by the interest rate movements.

- Liquid Funds

The Liquid funds invest in the debt instruments which do not have a maturity period more than 91 days and because of this reason they are risk-free. They experience less negative returns and these are a good alternative option for savings bank account as they provide similar liquidity and higher returns. There are many Mutual Fund Companies that offer instant redemptions on the liquid fund investments through special debit cards.

- Gilt Funds

These funds only invest in the Government Securities. The Government is the high-rated securities and they do not come with the credit risk. It is because the Government is not going to default on the loan which it takes in the form of the debt instruments. This makes the gilt funds ideal for the risk-averse fixed income investors.

- Credit Opportunity Funds

These are newer debt funds. Other than the Debt Funds, the credit opportunities funds do not invest according to the maturities of the debt instruments. These funds earn higher returns by taking a call on the credit risks. These funds hold lower-rated bonds which come with higher interest rates. The credit opportunities funds are risky debt funds.

- Fixed Maturity Plans

The Fixed Maturity Plans are the close-end debt funds. These funds invest in the fixed income securities such as the corporate bonds and the Government securities. They have the lock-in period feature as well. All the Fixed maturity plans have a fixed horizon for which the money is locked in. the horizon can be for a month or for years. The investments in the Fixed Maturity Plans can be made only during the initial offer period. It is like a fixed deposit that will offer or deliver superior, tax-efficient returns but does not guarantee returns.

How do the Interest Rates Affect the Debt Mutual Funds

There are basically to rates of interests which are quite popular. Those are the repo-rate and the reverse repo rate. These rates are decided by the Reserve Bank of India. The RBI lends money to the commercial banks at the repo rate. There are quite a number of factors that result in the increase and decrease of the interest rates. These interest rates also determine the rate at which the institutions issue the bonds and other debt securities. The price of the fixed income securities is inversely proportional to the interest rates. If the interest rates increase then the bond yield goes down and the vice versa. This is why the debt funds tend to earn higher returns when the rate of interests falls or when expected to fall as the prices of the bonds go up.

Who are Eligible to Invest in the Debt Mutual Funds?

For the conservative investors, the Debt Mutual Funds are best option to choose. These are a sort of ideal investments for them. They are good alternatives to the fixed deposits. If the debt funds that deliver the returns that are in the range of the fixed deposit interest rates, then they are tax-efficient than the fixed deposits. The interest income that is earned from the fixed deposits are added to your income and the tax is charged as per the slab you fall under. The Short-term gains achieved from the debt funds are also added to the investor’s taxable income. If their holding period is more than 3 years then they become tax-efficient by nature. The long-term gains are taxed at 20% after indexation.

The debt funds are liquid by nature when compared to the fixed deposits. Where the fixed deposits come in lock-in period, the debt funds can be redeemed at any time. Partial redemptions can also be done from the debt funds.

Hence, these are the reasons the debt funds are recommended in place of the fixed deposits. And always keep in mind before investing that, the Debt Mutual Funds do not guarantee capital protection or fixed returns.

How To Check EPF Balance In 2019 | Online

The EPF Balance is the balance that is present in the Employer’s Provident Fund (EPF) Account. The EPF Balance is nothing but the balance that is deducted every month from your salary along with an amount that is contributed to your EPF Account by your employer. Opening an EPF can be a very good idea for retirement savings.

The Employer’s Provident Fund launched an online inquiry platform in the year 2013. This online portal was launched in order to check the fund balance. The main objective of this portal is to provide a quick access to the customers who want to check their PF Balance online. This is a very important factor for any salaried employee. Checking PF Balance online can provide the customer’s current updates about the information of their accounts, doing this will be very helpful for those who wish to make partial withdrawals or to avail any Loan.

The EPFO (Employee’s Provident Fund Organization) has introduced different ways to check the EPF Balance.

The following ways to check the EPF Balance are:

- Via SMS

- Via Missed Call

- Through Online Via UAN

- Via the Mobile App

Earlier, when these services were not available, check the EPF Balance was tuff and complex. There was a number of forms which were needed to be filled, and people had to wait in the queues for hours and hours outside the office. In this article, we are going to learn about these methods in details.

How to Check EPF Balance IN 2018 Online

The EPFO has provided numbers of facilities to their customers. Recently, the EPF Balance can also be checked through online. Below are the steps to check the EPF Balance Online:

- For checking your EPF Balance, you need to make sure that you have your EPF Account number with you. This is the most important thing to keep in mind before you start to perform any activity.

- Open the link – epfindia.com and click on the “Know Your Balance” which is located at the bottom of the page.

- Select the state of the PF Office in which your EPF Account is maintained.

- After you select the EPF State, a list of offices pertaining to that state will be listed down below.

- Choose your city, EPF Office from the list. For example: If your PF State Office is Karnataka and the Local Office is in Bangalore, then select Bangalore as the city.

- Now enter your EPF Account number, your name as mentioned in the EPF Records and your Mobile Number.

- The format of the EPF Number is TN/MAS/0054232/000/0000222. If in case there are no three digits present in the middle is not present in your EPF Account then you can leave the box blank and proceed further. The first two alphabets are the code of the region and the next three alphabets are the code of the PF Office.

- Now click on submit and the EPF Balance will be sent to you through an SMS on the registered mobile number.

How to Check EPF Balance via UAN

UAN is also called as Universal Account Number which is allotted by EPFO. It is a Universal Account Number which is unique for all the individuals who have enrolled under the EPF Scheme. The UAN number does not change even if you change your Employer or PF account number. This number is assigned to each employee. This number can be generated by logging in the EPF Website. Once you have registered for UAN, you will automatically receive the details like EPF Balance etc. on your registered mobile via SMS.

The steps for checking an EPF Balance via UAN are as follows

- Open the webpage- uanmembers.epfoservices.in

- Enter your Universal Account Number (UAN).

- Enter the mobile number where you want to receive the SMS.

- Select the EPF State and choose the city-specific EPF Office from the list. For example, if your PF State Office is Karnataka and the Local Office is in Bangalore, then select Bangalore as the city.

- Fill in the captcha code and you will receive a Pin and all the EPF Balance details are sent to the mobile number.

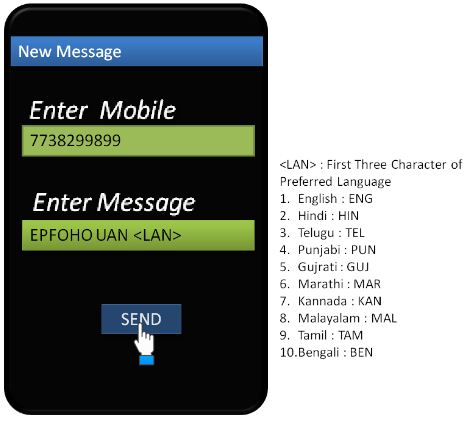

How to Check EPF Balance Via SMS or Missed Call

You can also check your EPF Balance through SMS or Missed Call. For this activity, you need to have an activated UAN Number. If you have a valid UAN Number then your mobile number is also registered with the EPF Department. You just have to give a missed call to 011-22901406 and you will receive an SMS that consists of the details of your PF Number, Age, and Name etc. In order to know your EPF Balance then you need to produce your UAN along with the Aadhaar Number or PAN Number.

To know your EPF Balance, KYC Details along with the UAN is mandatory. Once your UAN is integrated with your KYC, every time to give a missed call to the EPF Department, you will receive an SMS with the EPF Details along with the EPF Balance.

How to Check EPF Balance Through the Mobile App

The EPFO has recently launched a Mobile App for PF Balance tracking. The Mobile App serves different services such as the balance check as well as the Passbook Statement. This app is currently not available on the Google Play, so you can download it manually from the EPFO Official Website. Currently, this mobile app can only be used by the Android Users. The EPFO Department has been developing the app services for the Blackberry and IOS Devices.

On the EPFO App link, click and check the save target as. Once the app is installed on your device then open and feed your name and account number and track your PF Status. You can also download this file I the computer and later transfer it to the mobile phone. The file format is named as m-epf.apk and will be shown on your desktop or mobile wherever you want to download it.

Below are the steps to check the EPF Balance via Mobile App

- Open the Mobile App on the device and click on the Member Option.

Checking EPF balance using m-epf app - Under the Member Option there is an option available called as click balance/passbook and then enter your 12-digit UAN Number also enter your registered mobile number. The system will now verify your mobile number. If the number does not match then the UAN Number will display an error.

- If in case the Mobile Number and the UAN Combination is correct then it will display a message of your updated EPF Balance information along with the personal details (name, date of Birth, Aadhaar Number, PAN for tax Deductions, Last Month EPF Contribution etc.) that are present in your EPF Records.

- If in case you want to see your EPF Statement for the last 7 months, then you can select the option of “View Passbook” option and get a detailed statement.

The EPF Mobile App is good for EPF Balance Tracking and is the handy tool for checking the EPF Balance.

How to Access and Download EPF Passbook

The EPF Passbook is quite similar to that of the Bank Accounts Passbook. The Passbook carries the history of all the transactions including both the deposits and or any partial withdrawals. Below mentioned are the different modes through which you can access and download an EPF Passbook.

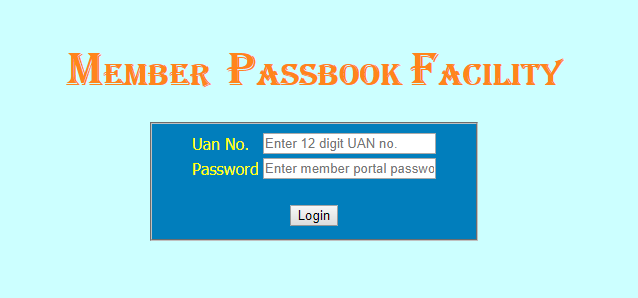

Using the UAN Portal

UAN can be used to download the EPF Passbook online from the EPFO Website and you can also track down the status of your EPF Transactions. The EPF Passbook has certain particulars regarding the Monthly PF Contribution from your employer and the contribution towards the pension scheme as well as the latest EPF Scheme. The EPF Passbook is like a full statement of all your transactions with the EPFO.

The only prerequisite for obtaining this passbook is to generate the UAN number, for which you can later Login and then download it.

Using the Member Portal

The EPFO has a member portal from where you can register online and view their Passbook transactions. This facility can be availed by the individuals whose employer has uploaded the Electronic Challan cum Return for the salary month of May 2012 and beyond.

The advantage of using a member portal is that you don’t have to remember any user name or Password. You just require only the registered mobile number and any identity proof like PAN, Aadhaar etc.

You can also feed multiple number of IDs along with the registered mobile number. Any of these ID Numbers can be used with the combination of the Phone number for the retrieval of the EPF Statement via EPF Passbook.

Thus these two portals can be used for accessing and downloading the EPF Passbook.

Points To Keep In Mind While Checking an EPF Balance

There are certain points that should be kept in mind while checking an EPF Balance are as follows:

- Only one mobile number is allowed for the registration at the member portal, for downloading a passbook.

- Any registered mobile number can view only one EPF account details, and for viewing more accounts, you will require a number of mobile numbers registered. You will need to file Form 13 for this process.

- One member is allowed to vie maximum 10 EPF Account balances.

- Multiple ID numbers can be added one after another during the process of registration so as to make use of the identity proof number during the time of the registration.

So, hope you have got enough of information regarding what is EPF, how can check the EPF Balance through different ways and the ways to access and download an EPF Passbook. Now, there must be some questions rising on your head such as, if there is a way to check the EPF Balance online, then there also must be a way to transfer the funds in EPF. Definitely, you can transfer the funds to EPF. Let’s see how, but before jumping to the topic, let’s understand what an EPF Balance Transfer is and why we need it?

EPF Balance Transfer

Did it ever happen that you’ve switched your jobs a multiple number of times and your provident funds have been resting in the accounts? Maximum of the answer would be a “Yes”. It has been seen that people usually forget to transfer their EPF Balance on time. Changing a job comprises multiple numbers of paper works and procedures and quite apparently, there is a swirl of confusions when it comes to the matters related to the EPF. Provident Funds provides a lot of benefits than the fixed deposits and other Government Bonds, so it is preferable to transfer the amount whenever you are switching a job. However, the employees also have an option to close their active EPF account and open a new one. Thus, undoubtedly EPF is known as the best long-term saving option that provides ensured income and saves your tax.

Features of EPF Balance

- The Employees can transfer their accumulated balance anytime from one account to another. But this funds cannot be transferred to a third person account.

- Along with the provident fund, the pension amount under Employee Pension Scheme (EPS) also gets deposited in the Employee’s new account. But for availing these benefits, the Government has mandated of having a minimum of 6 months of the work period.

- For the fund transfer to take effect, both the EPF account must have all the essential information such as the employee’s name, father’s name, date of birth etc. any mismatch or unavailability of information can lead to the rejection of the transfer request.

- The employees cannot transfer a portion of the EPF Funds to the new account and keep a few in the old account. The entire sum has to be deposited to the new account.

- The EPFO has launched an online submission system to facilitate the transfer of the provident funds. For the withdrawal of the EPF amount, the members can apply through their current or previous employer.

Note

EPF Contributions at the Rate of 10%

A PF of 10% interest is applicable to the people who are working under the following establishments:

- A company with less than 20 employees on its payroll.

- Any organization that suffers losses equal to its entire net worth.

- Establishments coming under Jute, Beedi, Brick, Coir and Guar Gum Industries.

- Any other establishments decided by the Board of the Industrial and Financial Reconstruction.

EPF Balance for the Inoperative Accounts

According to the notification issued by the Government in the year 2016, the inoperative accounts will build up interests and will not be classified as Inoperative anymore. Earlier the EPFO has stopped paying interests to the dormant accounts. But after the release of the new amendment, all the inoperative accounts will receive interests at 8.8% per annum. There are basically two reasons why the accounts were getting inoperative- firstly, due to the cumbersome process while EPF Transfer and people switching jobs frequently and opening new accounts.

New EPF Withdrawal Forms for Easy Claims

As we have mentioned it earlier, the EPFO has released new forms that facilitate the withdrawal procedures of the Provident Fund Amount without the employer attestation. These forms are Form 19 UAN, Form 10C UAN and Form 31 UAN. We have already discussed the Form 10C in the above section. Due to the introduction of these forms, the procedures have been minimized while making claims and EPF Transfers. By using these new forms, the individuals can apply for Final Claim Settlement, Full Withdrawal, Partial Withdrawal, and Loans. Form 19 UAN is applied if an employee wants to resign from the service or the employer terminates the employment agreement. Form 10C UAN is used for making claims related to EPS and Form 31 is used for making partial withdrawals or advances. The preconditions for the EPF Withdrawal without an employment signature are as follows:

- Form 11 of the employee must be available in the EPFO records.

- He/she must have a valid UAN

- The bank details and the Aadhaar must be available in the KYC Data.

If the employee does not fit the above criteria, then he/she will have to make claims using the regular EPF Forms:

| Form 19 | Click to Download |

| Form 10C | Click to Download |

| Form 31 | Click to Download |

Provident Fund Rules for the Railway Employees

A Railway Employee contributes 8.5% of his/her salary towards the State Railway Provident Fund. The EPF Balance of the Railway Employees is maintained by the Railway Accounts Department.

Name Mismatch in the EPF Account

If in case your name is misspelled incorrectly in the EPF account, then the procedure to rectify it is quite easy.

- All you have to do is submit an EPF name correction form along with the employer’s statement and other supporting documents such as PAN Card, Aadhaar Card, Voter ID Card or Bank account Passbook.

- The name change application should be addressed to the EPFO Commissioner specifying the errors that are found in the existing employee credentials.

Currently, the EPFO is working on the portal and is introducing to report the problems online. This web portal is still in the testing stage. Once the web portal is implemented, people can log in through their UAN and submit an online application for the name correction.

EPFO Customer Care

The sites are handled for 24 hours by the Officials of the regional centers. You can also visit the nearest EPFO Centers to get the information related to your account.

Tax Deductions for EPF Accounts with or Without PAN

The Indian Government has introduced a new section in the Finance Act 2015, whereby PF withdrawals will be subjected to the tax deductions. As per the new rule, all the withdrawals over Rs 50, 000 will be taxable at source if the employee has served less than 5 years. Even the individuals below the taxable income range will have to ante up 34% towards “PF Withdrawal tax”. However, if the EPF Account is linked with the PAN, then the rate of the deductions will be 10% per annum and the rate of interest without PAN will be 34.6% per annum. If an EPF member has filed Form 15G and H at the time of joining then the tax of deductions are not applicable for the withdrawals below Rs 2, 50, 000. If the PF amounts are withdrawn for health purpose or business failure or any such emergencies then, the tax deductions are exempted. Therefore, it is ideal that you save your taxes by securing your EPF Balance with PAN Number.

EPFO Digital Signature for Employers

The Centers have urged to all the organizations which are under the EPF Scheme has to apply for the digital signature. Doing this can lead an easy verification of UAN Data. The employers can upload their digital signature through Online Transfer Claim Portal (OTCP) of EPFO.

How to Download EPF Balance Slips

At the end of the salary period, the annual statements of the PF accounts are published on the EPFO website. This can be downloaded by the users/employers through the E-Sewa Portal. The step by step process to download the EPF Balance Statement are:

- Type the following URL in your webpage- epfindia.gov.in

- In the EPFO homepage, click on the link “For Employers”.

- From the services listed, select the “ECR/Challan Submission”.

- This will redirect to the “Employer E-Sewa” page.

- Click on the “Employer E-Sewa” link given on the page and sign in using the credentials.

- In downloads tab, select download PF Slips and choose your desired location and save it in PDF.

The EPFO is expecting to launch a massive drive throughout the country with an aim to increase maximum member enrollments. The Government has also issued different guidelines on the PF Settlements under which the death claims will be settled within 7 days from the date of the application and retirement claims before the date of the retirement.

Thus, the Employee Provident Fund provides a social security to all the employees who pay in the present and reap benefits in the future.

YES Bank Savings Account – Types, Interest Rate, Benefits and Features

Yes Bank is a public sector bank which was founded in 2004 and gradually became the fifth largest private sector banks in India. It is a commercial bank, headquartered in Mumbai, India.

Yes bank provides a variety of products and services in order to cater to the personal banking, business banking, and corporate banking. It has more than 600 branches and 2000 ATMs across the nation. It has also prospered in digital banking by offering a number of online and mobile services through their website and app, along with their digital payment.

Yes bank also offers a variety of savings account options to cater different needs of every customer. They also have a customisable option that allows customers to get a savings account with the benefits and features they desire.

A savings account is a deposit account held at a bank you have your account in and keep your money, earn interest on it and access it wherever required. It is the most basic type of banking instrument used by an individual. Almost every bank offers this facility that has a retail banking division whether it is a public sector bank or a public bank. However, banks can limit the number of withdrawals you can make from a savings account each month and they may also charge fees unless you maintain a certain average monthly balance in the account. And mostly, banks do not provide cheques with the savings account.

| Some Relevant Links | |

| Yes Bank Credit Card Customer Care Number | Click Here |

| Link Aadhaar With Yes Bank Account | Click Here |

| Yes Bank IFSC Code | Click Here |

Interest Rates on Yes Bank Savings Bank Deposits

| Particulars | Rate of Interest |

| Savings Deposit up to Rs. 1 Lakh | 5% P.A |

| Savings Deposit Between Rs. 1 Lakh and Rs. 1 Crore | 6% P.A |

| Savings Deposits above Rs. 1 Crore | 6.25% P.A |

Features and Benefits of Yes Bank

Yes bank has various features and it has its benefits. Keep reading to know some of the features and its benefits:

- Customers of Yes bank can enjoy the facilities of NEFT (National Electronic Funds Transfer) and RTGS (Real Time Gross Settlement) payment facility via Internet banking.

- Customers can also get a debit card along with some exciting offers. The debit card is a card which deducts money directly from a consumer’s checking account to pay for a purchase they make. It also put an end with the need of carrying cash or physical cheques to make purchases.

- If you have a savings account in Yes bank, you can also enjoy unlimited access to ATMs of any bank throughout the country as it has more than 2000 ATMs across the nation.

- You can also avail higher return of up to 6% P.A on the savings account.

- You can also make use of free Demand Draft (DD) issuance through both net banking and branches.

- Use your Yes bank savings account and in order to pay your utility bills at ease

- Enjoy life insurance Purchase Protection Insurance and Card Lost Liability

- Select an account number of your choice

- With the advancement in technology, you can apply, maintain and track your saving account very easily

- Get access to mobile and SMS banking, through which you can perform necessary task from your convenient place and time

- Yes bank also provides doorstep banking services for the comfort of its customers

How To Open Yes Bank Savings Account

If you want to open a Yes bank savings account, you can follow the below-mentioned procedure:

- Acquire savings bank eligibility form in order to proceed further. You can get the form online as well.

- Fill out the form properly and submit it.

- Once submitted, the website automatically checks the eligibility of the applicant

- Generate Account Number of your choice and use it for all future communication after that.

- Keep your KYC (Know Your Customer) documents handy.

- Bank representative will contact you shortly.

Keep the Following Points in Mind Before Applying for Yes Bank Savings Account

- Your name and address should match with what is mentioned in KYC (Know Your Customer) account

- Mention your correct email ID and mobile phone number as this will be used for all future communication related to the application

- Your account will be activated on completion of KYC and other related formalities

- Also please note that this service is only available for existing Yes bank customers. And existing customers can visit the nearest branch to open an account

Types of Yes Bank Savings Account

There are different types of Yes Bank savings account such as Personal savings account, salary savings account, custom savings account etc. Let’s discuss these savings accounts in details:

Personal Savings Account

- Savings Exclusively

If you are a customer of Yes bank, you can enjoy high returns on your account balance along with doorstep services, debit card with unlimited access to ATMs in India, tax benefits on interest and more.

- Savings Advantage

You can also enjoy a high interest rate of 6% p.a. which is payable on your account balance, free demand draft (DD) issues, tax – free interest for up to Rs. 10,000 earned and a free silver debit card.

- Savings Value

You can get complete value for money with low minimum balance requirements. If you are a customer of Yes bank, you can get other benefits offered by Yes Bank.

- Savings Select

Get high returns of 6% p.a. with the benefits of a silver debit card with unlimited access, sweep-in facility, and more.

Salary Savings Account

- Smart Salary Platinum

Get access to exclusive privileges and enjoy best-in-class services with this account. There is no minimum balance required. The debit card issued with this account is an International Platinum debit card.

- Smart Salary Exclusive

Customers can avail zero balance requirements with interest rate of 6% p.a. on your account balance. And Yes bank offers the Domestic Gold debit card with this account.

- Smart Salary Advantage

Customers are not required to maintain a minimum balance, high-interest rates on the balance, and best – in – class services make this an attractive salary account. Yes bank also offers the Domestic Silver debit card with this account.

Custom Savings Account

- Customizable Savings Account

This kind of savings account gives the customer power to design their savings account. The customer can choose their own debit card, pricing options, account benefit packages and complimentary introductory offers. This savings account can be tailored to suit an individual’s lifestyle and banking preferences. The customer can also eliminate unnecessary account features and charges which are not required.

- Create Your Own Savings Account

Yes Bank offers you the option to create your own Savings Account online and enjoy features such as quarterly interest payout, unlimited ATM benefits, tax benefits, branch services and digital banking.

What is Yes Pay

Yes bank has launched a digital wallet known as “Yes Pay” through which a smartphone or social media user can transact seamlessly for payments and receipts. To avail this service both customer or non – the customer can avail this service and can register for this wallet and receive a free virtual online card that can be used to make online transactions such as mobile and DTH recharges, purchase gift vouchers and discount coupons and pay bills.

There are several benefits of “Yes Pay” which are as follows:

- You can transfer money to Yes Pay users or bank accounts

- You can also send request for money from your contact

- If you wish to split bills or expenses amongst your group you can do so

- For in-app purchase, you can contribute a specified amount regularly

- You can also recharge your phone or DTH through Yes Pay

- You can hop online at over 30,000 merchants with a single click

- Along with the purchase of mobile or tablet with Yes Pay, you can also purchase insurance in order to protect against expenses for handset damage, replacement or loss.

- You can also get attractive rewards points for transactions made through Yes Pay

- You can pay your bills and also

- You can download the latest songs across a variety of categories

To use “Yes pay”, you can download the mobile app and register for e–wallet. Through Facebook, you can easily access your Yes Pay wallet without registration. Enter your mobile phone number and enter OTP (One Time Password) which you have received on your phone. You will also have to set a 6 – digit pin as your login ID. Also, enter your personal details and your wallet will be created.

And to use it you can simply load money through your Yes Bank Account or any other bank account using internet banking or a debit card or through IMPS. Once you receive the money in your wallet, you can transfer funds and pay for a variety of purchases and bills by selecting the “Yes Pay” option at the time of checking out.

All About Zero Coupon Bonds | 2019

In the earlier Era, the Bond documents played a vital role in the Government. They made a mark before the shares were available to the investors. The companies used to raise different funds with a written guarantee of the promise to pay it back later with interest. This guarantee is none other than the Bond. In India, the Bonds are broadly classified into two types: Government Bonds and Co-operate Bonds. In this article, we will be discussing the ‘Zero Coupon Bonds’ and what are its benefits and demerits and who should invest and what makes this investment unique and its formulation.

Usually, the Bonds are quite uninteresting and people don’t take much interest to talk about this. Most people will have only a partial understanding of how they work and what is the impact.

What are Zero Coupon Bonds

A Zero Coupon Bond is a debt security which is sold at a discount and the best part in it is that you do not have to pay any interest payments to the bondholder. In other words, it’s a bond that sells less than its face value and does not make any coupon payments or periodic interest payments during its life. At the time of maturity, this can be redeemed at its face value allowing the bondholder to make a profit.

It has been seen that in Companies, Schools and Government Workplaces, bonds are used as a way to the Finance Expansions and other long-term projects. Usually, the decision to issue a Bond starts with a proposal for new projects. When the authorized board or the Government Body approves the plan or any idea, then a Bond is issued. The process is not that easy. It might take few months to get the bond drafted and issued to the public. The interest rate and the terms of the bond are usually set when the bond is initially drafted up. And by the time, the draft is issued the interest rates change.

And this is the reason why the Bonds are usually issued either at a premium rate or at a discount. Since the stated interest rate of the bond cannot be changed that’s why the sales price of the bond is changed. A bond issued at a premium sells for more than a stated value. Like for an example, a Rupees 100 Bond can be sold for Rupees 500. Whereas, a discounted bond is different the price of the bond is set to lower value. Like for an example; A 100 Rupees Bond can be sold for 80 Rupees.

Why are Bonds Important

The Governments need to borrow money. They borrow money by selling the bonds in the private sectors. Usually, the investors are quite happy to buy Government Bonds. They are seen as the safe investment options and the investors get a guaranteed rate of interest in return.

Who Should Invest in a Zero Coupon Bond

The Zero Coupon Bonds are ideal for the people who require funds at a specific period of time especially, in the future such as children’s education or retirement or a planned tour. If in case you are not interested in watching the market trends and like the comfort of the “Invest and Forget” strategy then Zero Coupon Bond is the best option to choose.

If your growth investments graph is quite high and you want to add a little diversity to it, then zero coupon bonds will help you secure a guaranteed return for a fixed period of time. These bonds offer great discounts for long tenures of investment and are perfect for the long-term investment plans.

Formulation: Mathematical Representation of the Zero Coupon Bond:

The price of the Zero Coupon Bond can be calculated by using the following formula:

P=M/ (1+r) ^n

Where;

P= Price

M= Maturity Value

r= Investor’s required annual yield/ 2

n= Number of years until maturity *2

Like for an example; if you want to purchase a Company’s Zero Coupon Bond that has Rs 1000 Face Value which matures after 3 years and you will be earning an interest of 10% per year on the investment. Thus, according to the formula;

1000/ (1+ .05) ^6= Rs 746.22

The greater the length until the zero coupon bond’s maturity the less is the amount that the investor has to pay. So if the Company’s Rs 1000 Bond is matured in 20 years instead of 3 years then you have to pay;

1000/ (1+.05) ^40= Rs 142.05

Advantages/ Benefits of the Zero Coupon Bonds

- The Bonds offer good graceful returns on maturity while keeping the option of selling them on the secondary market open if the interest rates decline sharply.

- The investors do not have to pay any tax on the interest since the bonds are issued at a discounted price and later redeemed at a face value.

Disadvantages of the Zero Coupon Bonds

- The Consequence of Paying taxes over annual accrued (phantom) interests which are not received but after maturity creates a negative cash flow over the active lifetime of bonds.

- The Zero-Coupon Bond prices are highly volatile. When the market’s interest rate increase the zero-bond prices drop significantly, resulting in a great loss of capital when the investors sell the bond before the maturity period.

- For the Zero- Coupon Bondholders there is no benefit to raising the interest rates because there are no coupon interests to reinvest.

- Many zero coupon bonds have call provisions as they allow the investors to redeem the bonds before the maturity period before the interest rates are dropped.

How is Income from these Bonds treated

The inventors of the notified zero coupon bonds are issued by the NABARD and REC and are liable to pay only the capital gains tax on maturity. The capital appreciation is such cases is the difference between the Maturity Price and Purchase price of the Bond.

In case of the non-notified zero coupon bonds, the difference between the maturity and the purchase price is considered as Interest and is taxed accordingly.

Like the growth market, the fixed income security market must have a clear approach to the investment goals and horizon. The Zero Coupon Bonds can be a great option if used cautiously and in sync with your investment purpose.

Thus, the Zero Coupon Bonds are the long-term investments and they are sold without a stated rate of interest. This is why many companies and the Government Bodies do not have to worry about changing the interest rates. These bonds are sold at a discount and do not have to pay a standard monthly interest percentage like the normal bonds do. Instead, the investors receive a gain of an appreciated bond at maturity. Instead of paying regular interest payments, it provides you one lump sum amount at the time of maturity.