Home » Government Documents » PAN Card

Category Archives: PAN Card

Linking of Aadhaar Card with PAN Card is now mandatory, says Supreme Court

The Supreme Court here on Monday (6th February 2019) announced that the linking of Aadhaar with PAN Card is now mandatory for filing for Income Tax Returns. As a matter of fact, the court was hearing the Government’s plea against the Delhi High Court order allowing the appellant Shreya Sen and Jayshree Satpute to file the Income Tax Returns for 2018-19 without linking Adhaar with PAN Card.

Highlights

- The Bench comprising of the Justices, A.K Sikri, and S. Abdul Nazeer said that the court has already made his decision and upheld the Section 139AA of the Income Tax Act.

- The Court’s order came on an appeal filed by the Centre against the High Court ruled by Shreya Sen and Jayshree Satpute, saying that you can file your Income Tax Returns for the assessment year without linking your Aadhaar with PAN Card.

Whereas, the Supreme Court has declared that it is mandatory for the citizens to link their Permanent Account Number (PAN Card) with Adhaar Card while filing for Income Tax Returns.

The Bench comprising of the Justice, A.K A.K Sikri, and S. Abdul Nazeer said that the court has already made his decision and upheld the Section 139AA of the Income Tax Act. The order of the court came on an appeal filed by a center against the Delhi High Court, ruling by Shreya Sen, and Jayshree Satpute, to file the Income Tax without Linking Aadhaar with PAN Card. This was a relief for many of the citizens, as they will have to worry about the linking Adhaar with PAN, last year.

Later, the bench said that ”

The aforesaid order was passed by the High Court has the regard to the fact that the matter was pending consideration in this High Court. Thereafter, the Court has decided the matter and upheld the vires of section 139AA of the Income Tax Act. Therefore, the Linkage of PAN Card with Aadhaar Card is now mandatory”.

Shreya Sen and Jayshree Satpute filed their returns following the court order and the assessment has also been completed. Hence, the Supreme Court has now made it clear, that the individuals have to link their PAN Card with Aadhaar ID for E-Filing 2019-20.

| Some Important Links Related To The PAN Card | |

| Form 49A | Click Here |

| Apply For The PAN Card | Click Here |

| Track PAN Card Application Status | Click Here |

| Re Apply For Lost PAN Card | Click Here |

| PAN Card For NRI | Click Here |

| PAN Card Correction/Update | Click Here |

| Check PAN Card Number | Click Here |

| Apply For Duplicate PAN Card | Click Here |

| PAN Card Link With Aadhaar Card | Click Here |

26th September 2019 Verdict

As per the September 26th, 2018 verdict, which declared that the Unique ID is legally valid and can be used for getting subsidies as well as for linking it with PAN. Many of the taxpayers, were unhappy with the decision and did not want to link their PAN. The Government has maintained that it is critical to ensure that the individuals don’t evade taxes with multiple numbers of PAN Cards. The Government also said that the majority of the PAN Cards have been linked with the PAN Card.

Many of the activists are not happy with the latest verdict. Suman Sengupta, activist, civil engineer claimed that “We need to ask if the Aadhaar Card is a verified data or it has been audited”. If someone links the PAN with fraudulent ID and also links it with the Phone Number, then how will UIDAI or Income Tax Department verify that?

PAN Card | Structure, How to Apply, Eligibility & Benefits

The full form of PAN is Permanent Account Number. It is an official document. A PAN Card is a 10 digit alpha-numeric permanent number that is issued by the Income Tax Department under the Indian Income Tax Act, 1961 under the Supervision of the Central Board for Direct Taxes (CBDT). It is a unique identification number which performs as an identity proof. The card comes in a laminated form.

The PAN card is accepted as a Proof of Indian Citizenship. The PAN number is an important document and it is mainly important to carrying out the financial transactions and related activities. Some of them can be opening a bank account, receiving a taxable salary, sales, and purchases of the goods etc. The PAN Number holds the details of the citizen in a unique way.

| Some Important Links Related To The PAN Card | |

| Form 49A | Click Here |

| Apply For The PAN Card | Click Here |

| Track PAN Card Application Status | Click Here |

| Re Apply For Lost PAN Card | Click Here |

| PAN Card For NRI | Click Here |

| PAN Card Correction/Update | Click Here |

| Check PAN Card Number | Click Here |

| Apply For Duplicate PAN Card | Click Here |

| PAN Card Link With Aadhaar Card | Click Here |

Structure of a PAN Card

The PAN Card has 10 characters in the card which is classified into 5 parts. The first five characters are represented in alphabets whereas, the next four digits are numbers and the last number is again an alphabet. All these digits have to mean and are connected and denote the information about the account holder. Below mentioned are the details of the characters that are present in a PAN Card.

- First Three Characters – Here, these are the first three characters which are represented in the alphabet. They follow a particular alphabet series pattern starting from letter AAA to ZZZ. The I.T Department allocates the digits randomly and is a combination of letters like AZT/ ZRT.

- Fourth Character– The fourth character represents the status of the PAN card holder. This is the most character present in the PAN Card. The one who deals with the PAN Card usually checks on this character and gets to know about the status of the account holder. Strangely isn’t? Well, the fourth letter for the majority of the PAN Card Holders is the letter “P” which denotes “Person”. The other nine letter that can represent the fourth character is C, H, F, A, T, B, L, J, and G.

These letters stand for the following status

-

- C- Company

- H- Hindu Undivided Family

- F- Firm

- A- Association of Persons

- T- Trust

- B- Body of Individuals

- L- Local Authority

- J- Artificial Judicial Person

- G- Government

- Fifth Character– The fifth character represents the first alphabet of the PAN Holder’s last name or the surname.For example- A Pan Holder, Anil Grover, the “G” alphabet represents the fifth character of the PAN Card as his last name’s first alphabet is G. However, If after marriage your surname is changed, then the details on the PAN Card will remain unchanged.

- Sixth to Ninth Characters– These four characters are the sequential numbers starting from 0001 to 9999. Like the first three characters, the selection here is also random.

- Tenth Character– The tenth character in the PAN Card is an alphabet check digit which is the result of the calculation based on a formula that comprises all the nine characters.

With the help of this unique number (PAN Number), the Income Tax Department can link all the financial transactions of the person with the department. These transactions include tax payments, tax deducted at source, tax collected at the source, returns of income/wealth/gift and other specified transactions.

Therefore, we can say that the PAN Card number acts as a unique identification key to track financial transactions related to the taxable components prevent from tax evasion. The PAN Number remains unchanged even if you change your address anywhere in India.

Eligibility For a PAN Card and the Documents Required

There are different eligibility criteria and documents who wish to own a PAN Card. The basic criteria are as follows:

- Individuals– The applicant should be a citizen of India with a valid address Date of Birth and ID Proof. The ID Proof can be Aadhaar card, Voter ID Card etc.

- Hindu Undivided Family– In this case, the head of the family can issue for a PAN Card on the behalf of the family. The head of the family should provide a valid Identity Proof.

- Minors– The guardians/parents of the minors can apply for a PAN Card on the behalf of the minor by providing a valid ID Proof and valid ID.

- NRIs, OCIs, and POIs– If an applicant is an NRI, OCI or POI that is if an Indian citizen resides outside India can also apply for a Passport. He/she should provide a copy of his/her bank account statement in the present country as its address proof.

- Mentally Challenged Individuals– If an individual is mentally challenged then a representative can apply on the behalf of his/her. The representative will have to provide the following details of the applicant- (ID Proof, Address proof, and date of birth) along with his/her representative details.

- Companies– Companies which require PAN Card should register themselves with the registrar of the company and along with that, they must provide a copy of the registrar certificate.

- Partnership Firms/ Limited Liability Partnerships– This category of entities must be registered with the Government and must submit a copy of the registration certificate.

- Trusts– Trusts which are registered can apply for a PAN by submitting a copy of their trust deed or the registration certificate.

- Associations and Local Authorities– This set of people can apply for the PAN by just submitting the agreement or the registration certificate.

- Artificial Jurisdiction Person– This sorts of entities can apply for a PAN by submitting their ID Proof and address either in the form of Government documents or registration certificates.

- Entities with no office in India– Firms, companies, Artificial Jurisdiction in India etc with no office in India can apply for a PAN Card by submitting their valid ID Proof and address. These can either be a registration certificate from which country you stay attested by the Indian Embassy or the Consultant of the country. If this option is not possible then the applicant get a registration certificate in India with approval documents from relevant authorities.

Validity of a PAN Card

If you have applied for a PAN Card in India, then its validity is for the life time. It remains unchanged even if you change your residence address, get married or shift to a place due to employment or job transfer.

How and Where Can You Apply For a PAN Number?

You can apply for a PAN online as well as offline. For applying PAN offline you need to download Form 49A or Form 49AA.

Form 49A– It is an application form for the allotment of the Permanent Account Number in case of an Indian Citizen/India.

Form 49AA– Whereas, Form 49AA is the application form for the allotment of Permanent Accountant Number for Foreign residents and entities.

You can download this form at the official website of Income Tax Department or National Securities Depository Limited (NSDL). You can also find the location of the PAN Offices in any city. Photocopy of identity proof and address proof is also required and payment is done via Cash, Cheque, and DD if in case you are applying it Offline.

Click here to download the Form 49A from the official NSDL website.

If you are applying it online then visit the official website of Income Tax Department or NSDL and can make payments via net banking, credit card, debit card etc. And you can even track your application form online.

Where Can You Use A PAN Card

- It is necessary to show a PAN Card while buying or selling immovable objects.

- When you are buying automobiles, you require a PAN Card.

- Buying banker’s draft, pay orders and checks requires a PAN Card.

- When you buy shares or debentures exceeding 1Lacs then you need to show your PAN Card.

- PAN Card is necessary when making deposits more than Rs 50,000.

- PAN Card is also required for creating a bank account, applying for a credit card purpose.

- Finally, you can produce your PAN Card as a valid photo ID proof.

Benefits of Having A PAN Card

The Benefits that you can enjoy for having a PAN Card are:

- The PAN Card carries your name, address, and date of Birth. Hence it serves as a National Accepted Proof of Identity.

- With a valid PAN Card, you can perform an unlimited financial transaction. You can connect to a landline as well as cell phone connection, buy and sell properties.

- If You are an NRI, then you can easily buy a property and own a business in Inda with the help of your PAN Card. You don’t need to file an ITR for that.

Need for a PAN Number

The PAN Number is a highly used and demand identification number. It is also used for the payment of direct taxes. It is also required for filing an Income Tax Return and to avoid deduction of taxes due to the due date.

Thus, we found out that there are a lot of uses of a PAN Card. PAN Card has quite a lot of advantages. PAN Card also carry transactions which are the normal and high amount. So you should make no delay to apply for a PAN Card.

Applications of a PAN Card

There are various sectors where the PAN Card is needed. These are the following different sectors where your PAN Card is a must needed.

- ITR Filing: This is the hottest of the news which is being discussed these days. It is the Income Tax Rate Filing. Here all the individuals and the entities who are eligible for the Income Tax are requested to file an ITR. While filing for an ITR, PAN card is a must require.

- Opening A Bank Account: Existence of PAN Card number is a must while opening a bank account. Whether it is a savings account or a current account. All the banks, be it public, private or co-operative bank submission of a PAN Card is a must.

- Buying or Selling A Vehicle: If you are planning to buy or sell a motor vehicle whose worth is more than Rs 5,00,000 then you need to show your PAN Card while conducting the transaction.

- Applying for a Credit or a Debit Card: When you are applying for a Debit Card or Credit card at any bank or any financial institution then you need to provide your PAN Card as it is mandatory.

- While Making An Investment: If you are planning to make an investment then you need to provide your PAN Card details for any transactions amounting above Rs 50,000.

- Proof of Identity: The PAN Card is used as a valid proof of identity, as well as Proof of address, proof of age, and proof of identity while making an application for Passport, Driving License, Electricity Connection etc.

- Foreign Exchange: If you are planning to travel abroad and you need to change your currency for that. In that case, you need to furnish your PAN Card details at the money exchange bureau/bank/financial institution.

- Insurance Payments: As per the Income Tax Department Norms, you need to submit the PAN Card details if you are making the transactions of insurance above Rs 50,000.

- Telephone Connections: If you are planning to take a new mobile connection then it is mandatory to submit the PAN Card details as the private cellular operators will not provide you a connection without it.

- Property: If you are planning to buy or sell a property in India, you require PAN Card for it. In case of buying a property the PAN details of the buyer as well as the seller must submit their PAN Card proof.

- Other fields of applications are; Cash Deposits, Fixed Deposits, Purchase of Jewelry etc.

PAN and Aadhaar Linking

Income Tax department has made it compulsory to link PAN with Aadhaar, setting 31st Dec 2017 as the deadline for same. This step has been taken to remove the usage of Multiple PAN Cards by a single Tax Payer. Usage of Multiple PAN Cards helps a tax payer in Tax avoidance. To know more about How to Link your PAN with Aadhaar Please Click here.

How To Re-Apply For A Lost PAN Card | Simple Steps

PAN also called as Permanent Account Number consists of a 10 digit alpha-numeric number. It is used as an Identity Proof and is issued under Income Tax Act 1961. The PAN Card is issued by the Income Tax Department under the supervision of Central Board of Direct Taxes (CBDT). PAN is one of the most important official document that every taxpayer have with them. PAN Card helps in carrying out high-valued transactions. PAN Card is also issued to the Foreign Nationals like investors as a subject to a valid Visa, unlike Aadhaar number and Driving License.

The PAN is important for major functional transactions like opening a bank account, ITR Filing, receiving Taxable Salary, Sale or Purchase of Assets etc.

Due to the heavy usage, there is quite a lot of chance to misplace or lose the card somewhere. A lost PAN Card can be very risky but the Government has contributed enough of the facilities to avail a Duplicate PAN Card.

| Some Important Links Related To The PAN Card | |

| PAN Card Information | Click Here |

| Apply For The PAN Card | Click Here |

| Track PAN Card Application Status | Click Here |

| Form 49A | Click Here |

| PAN Card For NRI | Click Here |

| PAN Card Correction/Update | Click Here |

| Check PAN Card Number | Click Here |

| Apply For Duplicate PAN Card | Click Here |

| PAN Card Link With Aadhaar Card | Click Here |

Steps To Apply For A Lost PAN Card

If you have lost your PAN Card then follow these simple steps to get it reprinted.

- Visit the official website of TIN-NSDL: www.tin-nsdl.com and go to the section “Online Application of PAN”.

- Now choose the option “Reprint of PAN Card”. This option is meant for the lost and stolen PAN Card.

- When you click on the link, you will be redirected to another page, where you need to click on the link “Online Application For Changes/ Correction in PAN data link”.

- Now, when you click on the link, you will be redirected to the page where the guidelines and instructions are viewed. Click Next after reading the instructions.

- Now you can fill in the application form. Provide the details like the Permanent Account Number Details, Name, Communication Address, Telephone Number, email ID etc. Documents such as photograph and ID Proof must be submitted along with the form. The applicant must submit it before the submission of the form.

- You can either submit the form online otherwise can post it to NSDL, along with the required documents.

- The payments are on the basis of your communication address, if you are staying within the country then you need to pay an amount of Rs 107. If you are staying outside India then you need to pay an amount of Rs 989.

- Accepts Net Banking, Debit cards, Credit Cards mode of payments if done online. If done offline then a demand draft is done for the payment.

- When your payment is successful, an acknowledgment number is provided along with the form. This acknowledgment number can be used in future to track down the application status.

- Then after, a duplicate PAN with the same PAN details will be sent to the registered communication address.

The Government in the last budget introduced a new law which said that it is mandatory to link PAN Card with Aadhaar. The last date to link PAN with Aadhaar is 31st December 2017.

Read here Complete procedure of How to link Aadhaar Card with PAN Card.

SBI will “redesign” Window Envelopes to safeguard PAN & Other Details

State Bank of India will redesign its envelopes which they used for the purpose of dispatching tax refund cheques of customers in order to cover their PAN (Permanent Account Number) and contact numbers. This decision has been taken by the SBI authorities after an activist raised this issue where the indispensable personal information was visible to anyone, which may result in mishandle, said the bank authority.

The decision has came forth after 16 months from when Commodore (retd) Lokesh Batra brought the issue to the light where the window envelopes used by the bank for dispatching tax refund cheques purpose, makes it easy for someone to glance through Permanent Account Number (PAN) and contact number of the taxpayer and can misuse it.

The complainer wrote to the RBI (Reserve Bank of India) Governor Urijit Patel claiming that SBI was violating its directions on ‘protection of customer’s information’ by sending crucial information about customers in “unsecured envelopes”.

He also said that he had been “pleading” to the higher authority of the SBI for the past 16 months to ensure to adhere with RBI directions, but nothing has changed.

Once RBI referred the matter to the bank i.e. SBI, the bank responded by saying that

How To Track PAN Card Application Status | via NSDL Official Website

The full form of PAN Card is Permanent Account Number. It is an official document. A PAN Card is a 10-digit alpha-numeric permanent number that is issued by the Income Tax Department under the Indian Income Tax Act, 1961 under the Supervision of the Central Board for Direct Taxes (CBDT). It is a unique identification number which performs as an identity proof. The card comes in a laminated form.

The PAN card is accepted as a Proof of Indian Citizenship. The PAN number is an important document and it is mainly important to carrying out financial transactions and related activities. Some of them can be opening a bank account, receiving a taxable salary, sales, and purchases of the goods etc. The PAN Card holds the details of the citizen in a unique way.

| Some Important Links Related To The PAN Card | |

| PAN Card Information | Click Here |

| Apply For The PAN Card | Click Here |

| Re Apply For Lost PAN Card | Click Here |

| Form 49A | Click Here |

| PAN Card For NRI | Click Here |

| PAN Card Correction/Update | Click Here |

| Check PAN Card Number | Click Here |

| Apply For Duplicate PAN Card | Click Here |

| PAN Card Link With Aadhaar Card | Click Here |

Modes to Track PAN Card Application Status

Receiving a PAN card takes an approx of 15 working days after applying for it. The Government has made it easier to track down the application status of the PAN Card. Hence to get an update on the movement of the application form of PAN Card, a 15-digit acknowledgment number is provided. Through this an individual can get the current status of the PAN.

You can check your PAN Card Application status in three different ways:

- SMS Facility

- Telephone Call

- Online Tracking Facility

Tracking PAN Card Status Through an SMS Facility

The applicants can track their application status by using a specialized SMS service. The individual must send an SMS in the following way “NSDLPLAN-15-digit acknowledgment number to 57575“. After sending the SMS, you will receive a current status of your application form.

Tracking PAN Card Application Status Through a Telephone Call

Here, the applicants can make a call in the call center and get the details of the current status of the PAN Card. The applicants can call on this number 020-27218080 to know about the status of the PAN card.

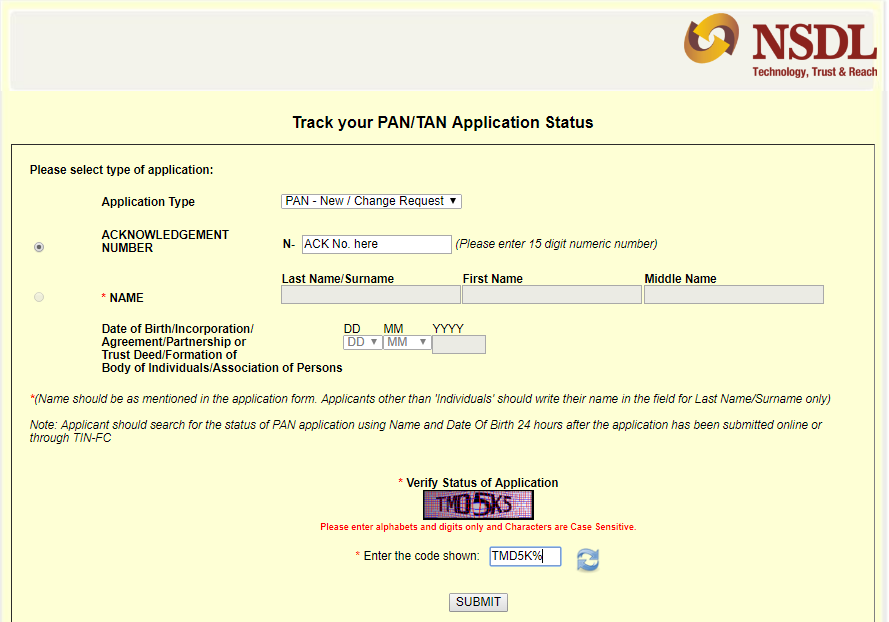

Online Tracking of PAN Card Application Status

- The Applicants those who are applying for the PAN Card and want to track down the application status can choose the online facility:tin.tin.nsdl.com/pantan/StatusTrack.html

- The Applicants must log in to the official website for PAN, TIN-NSDL. Once you visit the page, navigate the PAN section on the website. In the page, you can find an option to check your application status.

- The applicant is required to choose the required application type -(New PAN Card or Updated Information) along with a few personal dates and a 15-digit acknowledgment number.

PAN Card Status tin.tin.nsdl.com - After providing the following details the website will redirect you to a new page showing your current status of your PAN application.

Points to Remember while tracking your PAN Card

- The applicant can track his/her application status after 3 days of filing the PAN application form.

- You may not find correct details if you track your PAN application status within 3 days.

- Online tracking of PAN is possible only for 24 hours after an application is submitted online.

- Thus, we found out that there are a lot of uses of a PAN Card. PAN Card has quite a lot of advantages. PAN Card also carry transactions which are the normal and high amount. So, you should make no delay to apply for a PAN Card.

Frequently Asked Questions About PAN Card Status Tracking

Question: How Can I know my Acknowledgement number of PAN Card?

When you apply for the PAN Card you are provided with a 15 digit Acknowledgment Number, which will help you to track the status of your PAN Card Application.

It will be sent to email when you apply online or will be on the receipt of your application when you apply offline.

Question: How much time does it take for PAN Card?

Usually. it takes 15-20 days for a newly generated PAN Card to arrive at your doorstep via Mail.

Nowadays, the authorities have started emailing PAN Card applicant with the PAN Card Number that can be used for most of the transaction within 48 hours of Online Application